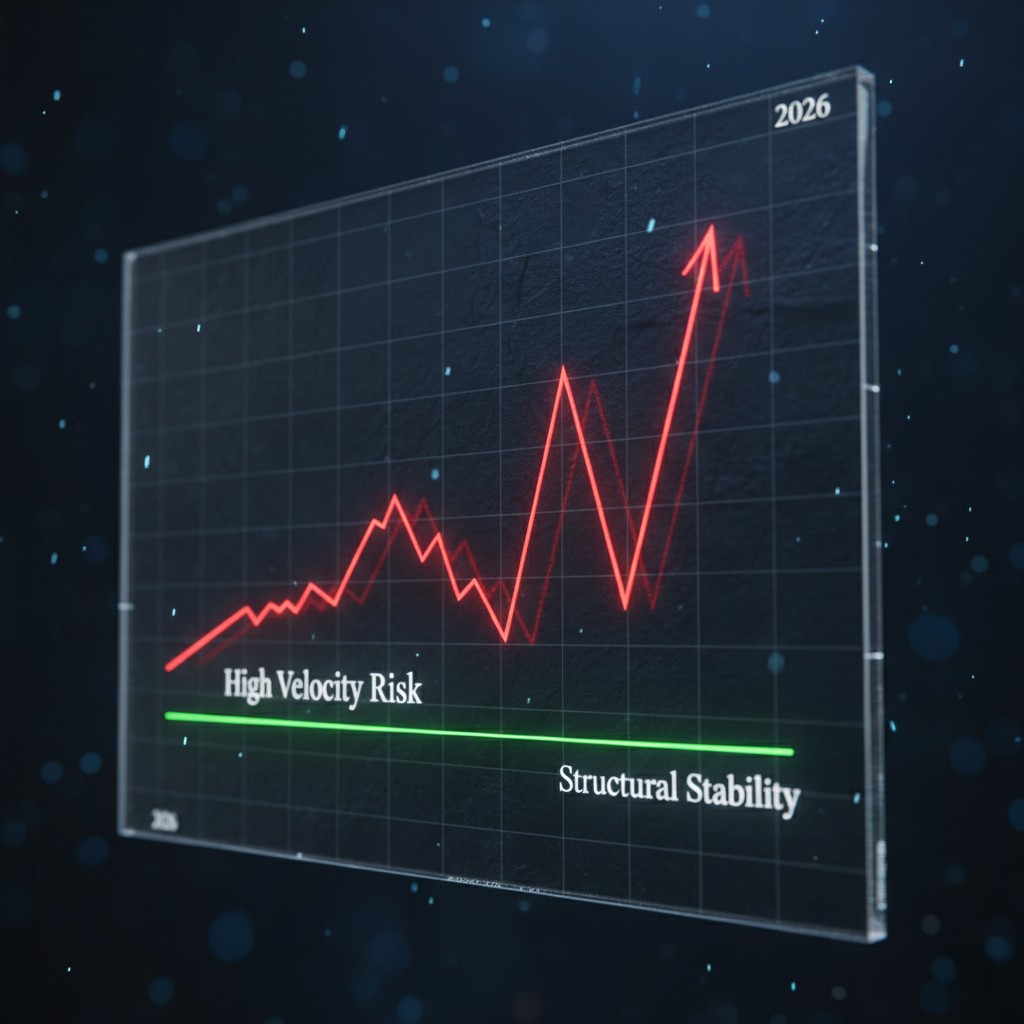

This research builds on our previous analysis of automated debt swap logic. We now examine how 2026 risk engines interpret activity after a loan intervention. Modern algorithmic models prioritize a kinetic metric known as Re-Utilization Velocity. This metric measures the time gap between clearing a credit line and using it again.

In the 2026 credit market, AI risk engines view a consolidation event as a baseline. They do not see it as a final solution. The speed of credit re-engagement provides a clear signal to lenders. It shows whether the intervention fixed the structural problem or merely provided temporary relief.

The Impact of Re-Utilization Velocity on AI Systems

AI systems categorize borrowing activity into distinct velocity tiers. Any immediate increase in Re-Utilization Velocity triggers a diagnostic window after debt restructuring. If a profile re-uses over 15% of available capacity within 30 days, the system identifies a high-risk event. Regulatory bodies like the CFPB monitor these behavioral patterns closely.

Lenders use these kinetic signals to identify a lack of fiscal seasoning. Rapid credit reuse suggests an unresolved cash flow deficit. This remains true even if the technical consolidation succeeded. This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

Mitigating Risks of Behavioral Recurrence Patterns

Structural friction dynamics determine how AI interprets these rhythms. Earlier research on AI lenders and slow data requirements shows that auditors penalize an immediate thirst for liquidity. A rapid return to debt suggests the borrower still faces the Endowment Effect. They see cleared credit as wealth rather than a latent liability.

AI auditors reduce trust velocity when they detect behavioral recurrence patterns. This shift typically results in lower credit limits. It also increases the risk premia on future products. The system views rapid reuse as a failure of the systemic mechanics meant to stabilize long-term solvency.

Re-Utilization Velocity and Dopamine Regression

Behavioral researchers have identified a specific event called Dopamine Regression. This event correlates directly with credit reversion behavior. Psychological relief often follows the zeroing of high-interest balances. This relief neutralizes the “pain of paying” and triggers velocity spikes in new debt.

Profiles that maintain a 90-day “Cooling-Off Period” show better long-term results. They have a higher probability of maintaining debt-free status. These trends carry heavy weight in debt consolidation failure analysis. AI treats the ability to leave credit lines dormant as a primary sign of creditworthiness.

Utilizing Hypothetical Modeling Tools

Sophisticated borrowers adopt a strategy of intentional latency to counter negative signals. They use hypothetical modeling tools to simulate the impact of new spending. This allows them to see the results before the AI audit trail records a kinetic signal.

In 2026, stability depends on the cadence of engagement, not just the score. Understanding the risks of rapid credit re-engagement helps participants move beyond reactive spending. This knowledge supports a structured and observation-aware financial strategy.

Research Abstract: Kinetic Velocity Auditing

This study defines Re-Utilization Velocity as the primary predictive marker for secondary debt cycles in 2026. By measuring the speed of credit re-engagement post-consolidation, AI systems accurately forecast long-term solvency failure.

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.