Following our longitudinal study of Algorithm Reverse Engineering Risks, this research explores Algorithmic Credit Mutual Aid as a direct systemic consequence. The previous analysis established that AI models identify non-organic profile manipulation through metadata calibration. Consequently, this study examines how institutional frameworks evaluate the probabilistic integrity of joint debt offsetting and collective credit signatures.

The Mechanics of Algorithmic Credit Mutual Aid

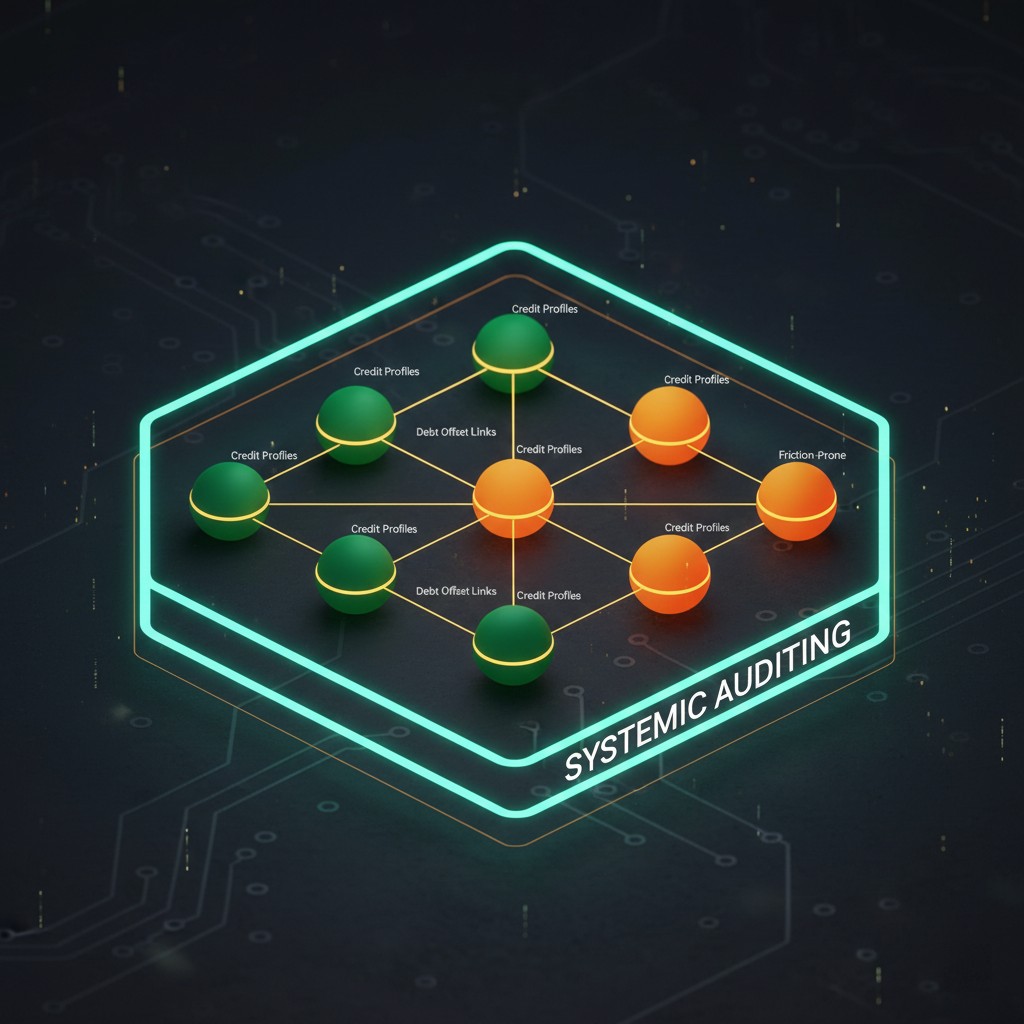

In the 2026 financial ecosystem, Algorithmic Credit Mutual Aid refers to a modeled state where multiple credit profiles are synthetically linked to offset individual balance-sheet conditions. These systems utilize discrete state recognition to determine the structural consistency of the collective group. Therefore, the auditing engine no longer views the borrower as an isolated entity but as a node within a broader probabilistic network.

The system evaluates the real-time transactional velocity between participants in the mutual aid pool. Moreover, these models identify the financial inflection point where the collective liquidity buffer is insufficient to cover systemic liabilities. When this mismatch is detected, the probabilistic evaluation layer may trigger a cohort-wide exposure recalibration to maintain institutional solvency.

Joint Debt Offsetting and Probabilistic Evaluation

Joint debt offsetting relies on the algorithmic alignment of diverse asset classes and liability streams. Algorithmic Credit Mutual Aid frameworks scan for latent risk markers within these pooled structures to prevent non-organic credit expansion. As a result, the system prioritizes profiles that exhibit a high degree of metadata calibration across all participating nodes.

The Federal Reserve continues to analyze the macro-prudential implications of these decentralized credit structures. Data correlates more strongly with the aggregate repayment cadence of the group than with individual collateral valuations. Consequently, a failure in a single node within the mutual aid network can produce a forward-looking systemic indicator affecting the entire cohort’s credit availability.

Systemic Sensitivity in Collective Auditing

Probability-based auditing identifies specific state transitions where a mutual aid pool moves from “Balanced Offsetting” to “Clustered Risk.” For instance, a synchronized increase in revolving credit usage across multiple linked profiles triggers a high-sensitivity audit state. Therefore, Algorithmic Credit Mutual Aid requires a high level of transactional transparency to avoid being classified as a systemic friction marker.

Moreover, the system interprets excessive internal debt swapping as a sign of structural instability. In contrast, pools that demonstrate consistent organic cash-flow injections maintain a more stable statistical relationship with institutional lenders. As a result, 2026 frameworks reward collective profiles that exhibit sustained structural integrity over those relying on complex liability masking.

Navigating Peer-to-Peer Solvency in 2026

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider. To analyze the mathematical foundations of joint offsetting, observers utilize our resources page as an interpretive modeling aid.

Managing Algorithmic Credit Mutual Aid requires an understanding of how behavioral credit auditing shift 2026 logic evaluates peer-linked metadata. Moreover, the system favors groups that exhibit diversified revenue streams and low correlation in their asset erosion cycles. Therefore, the strategic management of collective credit must focus on maintaining a balanced solvency marker across the entire network.

Conclusion: Collective Integrity as a Systemic Guardrail

The evolution of Algorithmic Credit Mutual Aid signals a shift toward networked risk management. In contrast to legacy individual scoring, the 2026 environment functions as a continuous probabilistic evaluation of inter-profile dependencies. Consequently, the resilience of a mutual aid structure depends on its ability to maintain data authenticity and structural consistency throughout shifting economic cycles.

Research Abstract

Background: This research analyzes the algorithmic logic behind credit mutual aid and joint debt offsetting in 2026. It explores how AI models utilize discrete state recognition to evaluate collective credit signatures, identifying the systemic thresholds where networked liabilities trigger automated exposure recalibrations across linked profiles.

| Network State | Data Signature | AI Audit Response | Systemic Impact |

|---|---|---|---|

| Balanced Offsetting | Low correlation in default risk | Baseline metadata calibration | Stable credit expansion |

| Structural Divergence | High internal debt swapping | Triggers discrete state review | Exposure freeze / Monitoring |

| Clustered Instability | Synchronized liquidity erosion | Probabilistic sensitivity alert | Cohort-wide silent contraction |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.