Following our longitudinal study of Medical Debt Probabilistic Evaluation, this research explores Revolving Credit Consistency as a direct systemic consequence. The previous analysis defined medical liabilities as stochastic shocks; in contrast, revolving credit usage represents a continuous, voluntary behavioral signal. Therefore, this study examines how 2026 institutional frameworks interpret the rhythm of credit card utilization as a primary marker of structural integrity.

The Mechanics of Revolving Credit Consistency

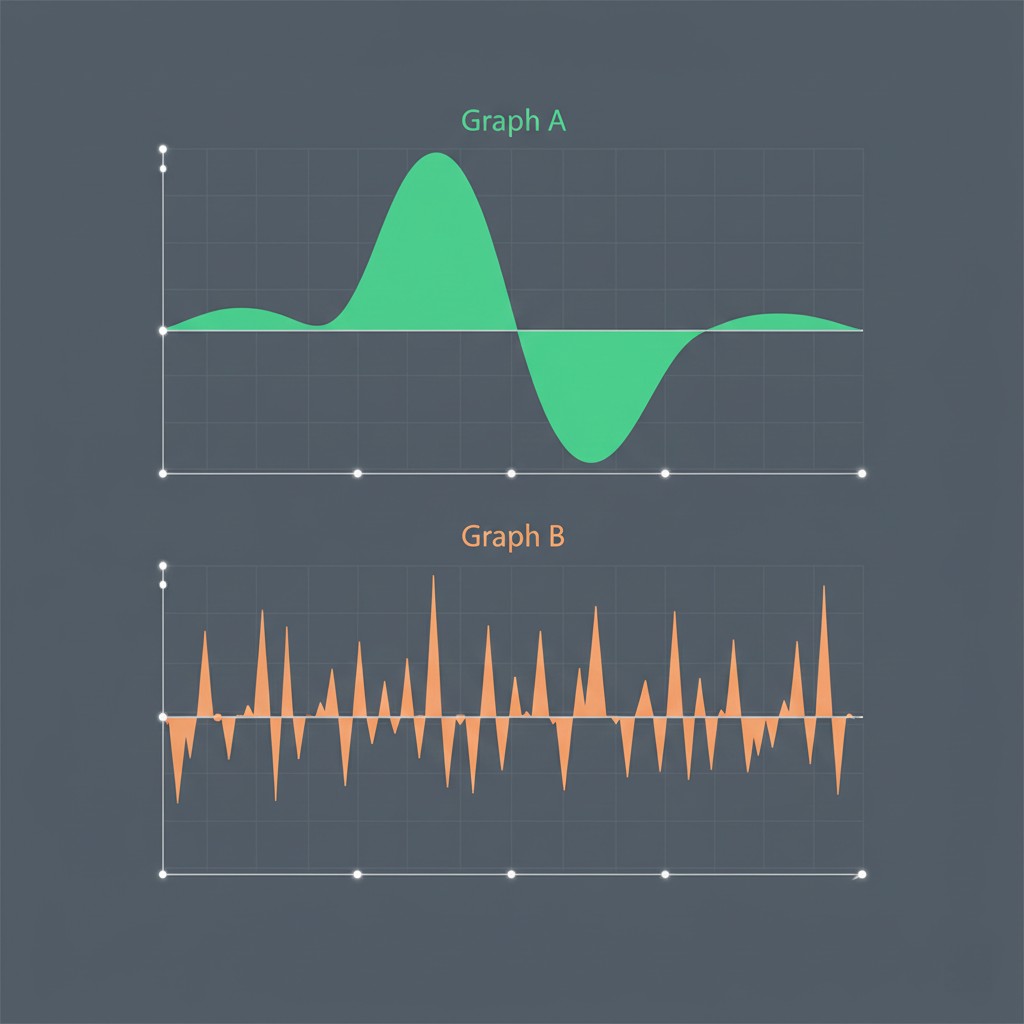

In the 2026 auditing environment, Revolving Credit Consistency refers to the mathematical stability of an agent’s utilization ratio over time. Unlike legacy models that merely flagged high balances, modern systemic mechanics analyze the “Oscillation Amplitude”—the variance between the highest and lowest balance points within a billing cycle. Models interpret erratic oscillation as a sign of liquidity stress, even if the minimum payments are met.

Institutional models utilize metadata flow observation to detect “Utilization Spikes” that lack a corresponding income event. For instance, if an agent’s credit line usage jumps from 10% to 80% without a correlated deposit in their connected asset accounts, the probabilistic evaluation layer adjusts the profile’s risk weight. This adjustment occurs because the system views the divergence as a potential “Relief-Seeking” behavior rather than planned consumption.

Behavioral Recurrence and Utilization Velocity

The integration of velocity metrics into Revolving Credit Consistency allows systems to predict long-term solvency states. Oversight mechanisms track the speed at which a balance is paid down—termed “Repayment Velocity.” A profile that demonstrates a slow, minimum-payment-based reduction curve often correlates with a “Cyclical Dependency State.” Consequently, the system classifies this pattern as a latent risk marker, suggesting the agent is relying on credit for operational subsistence.

The Federal Reserve notes that consumer credit dynamics have shifted toward algorithmic interpretation of spending volatility. Data correlates more strongly with the predictability of the repayment signal than with the total credit limit available. Therefore, the system rewards agents who maintain a “Flatline Utilization” pattern—where usage remains within a tight, predictable band—with higher structural trust scores.

Discrete State Recognition in Credit Lines

Probability-based auditing identifies specific state transitions when revolving behavior deviates from the established baseline. Within the framework of Revolving Credit Consistency, the system monitors for “Category Drift”—a sudden shift from discretionary spending (e.g., retail) to essential spending (e.g., groceries, utilities) on credit lines. Moreover, the oversight mechanism cross-references these shifts with the digital footprint to validate the underlying economic cause.

In contrast to manual reviews, 2026 models prioritize the “Entropy of Usage.” As a result, agents who exhibit low entropy—meaning their spending and repayment patterns are highly repetitive and boring—maintain a robust statistical relationship with lending algorithms. This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

Navigating Utilization Dynamics

To analyze how systemic review engines weight utilization variance, researchers utilize our resources hub as an analytical modeling aid. Managing the metadata associated with revolving lines requires an understanding of how behavioral credit auditing shift 2026 logic evaluates the noise-to-signal ratio in spending habits.

The system favors profiles that treat credit limits as operational buffers rather than liquidity extensions. Moreover, the strategic alignment of payment dates with income receipt dates creates a “Synchronized Flow” that enhances the profile’s structural integrity. Therefore, maintaining a stable trajectory in Revolving Credit Consistency involves minimizing the volatility of the digital signal projected to the credit bureau.

Conclusion: Stability as the Ultimate Metric

The reliance on systemic mechanics to monitor utilization confirms a shift in credit reversion behavior. Systems no longer view a zero balance as the only positive state; instead, they value the controlled, rhythmic management of active lines. Consequently, the resilience of a credit profile depends on its ability to project a low-variance, highly predictable pattern of Revolving Credit Consistency that reinforces the algorithmic confidence of the auditing layer.

Research Abstract

This research analyzes Revolving Credit Consistency as a behavioral metric in 2026 systemic auditing. It explores how AI models utilize “Oscillation Amplitude” and “Repayment Velocity” to distinguish between stable operational usage and relief-seeking dependency patterns.

| Behavioral Pattern | Systemic Marker | Probabilistic Impact |

|---|---|---|

| Flatline Utilization | Variance <5% month-over-month | Structural integrity confirmed |

| High Oscillation | Erratic spikes followed by minimum payments | Latent risk marker applied |

| Category Drift | Shift to essential goods on credit | Modeled stress state recognition |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.