Following our longitudinal study of Strategic Friction: The Cost of Excessive Inquiries, this research explores Cognitive Tunneling as a direct systemic consequence. The previous analysis established that systems introduce latency when application density spikes; conversely, the psychological state driving that density often involves a narrowing of focus. This study examines how 2026 behavioral frameworks interpret “tunneling” not as a personal failure, but as a measurable data marker for impending state transitions in credit profiles.

The Mechanics of Cognitive Tunneling

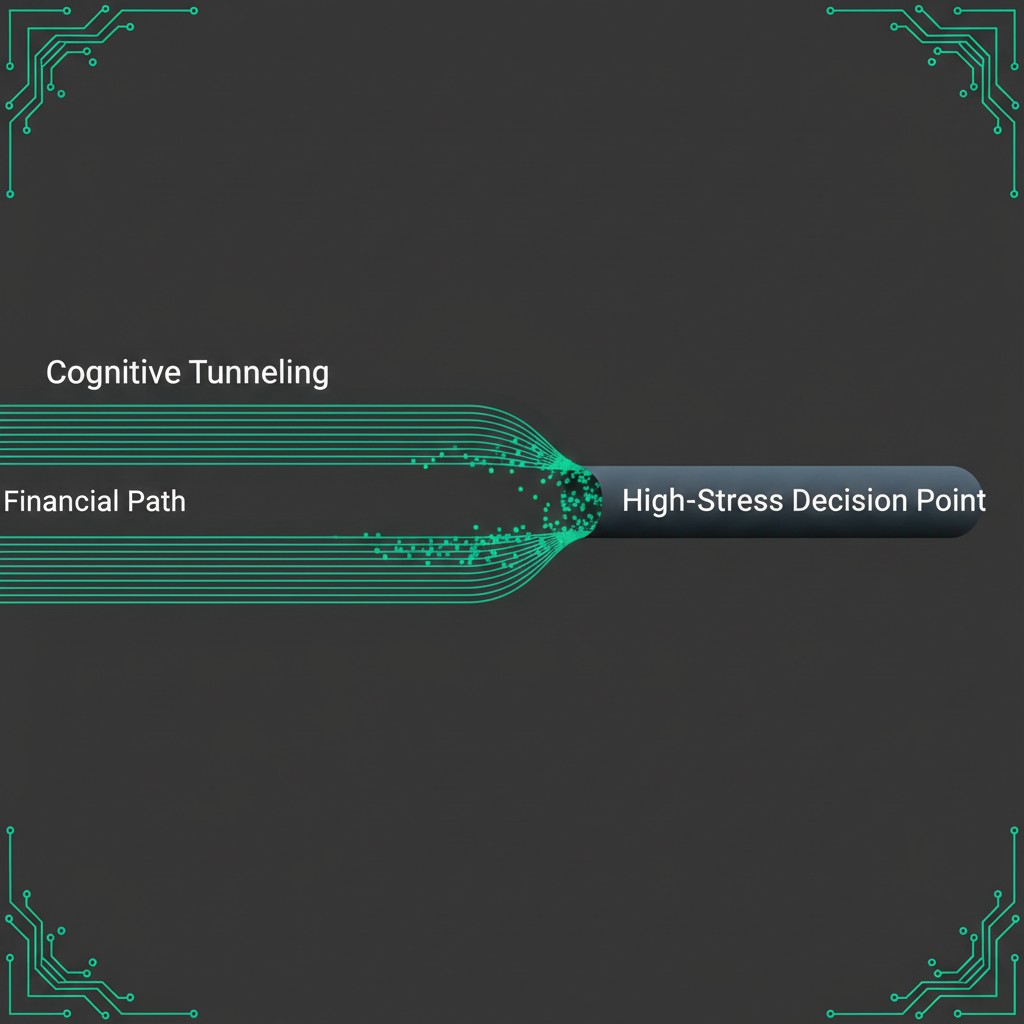

In the 2026 institutional landscape, Cognitive Tunneling refers to the psychological phenomenon where an agent, under high financial stress, focuses exclusively on immediate liquidity needs while ignoring long-term systemic risks. Systemic mechanics prioritize “Holistic Awareness.” When an agent’s transactional metadata shows a sudden concentration on short-term high-interest instruments, the oversight mechanism detects a loss of peripheral financial vision.

Institutional models utilize metadata flow observation to identify “Attention Narrowing.” For instance, a profile that neglects long-term amortization schedules to prioritize micro-liquidity events triggers a specific state recognition protocol. The system views this as a transition from “Strategic Planning” to “Survival Mode.” Consequently, the probabilistic evaluation layer adjusts the profile’s risk weight, as the agent is modeled to be within the Relief Trap—a state where short-term relief compounds long-term structural instability.

Systemic Detection of Psychological Default

The integration of psychological metrics into Cognitive Tunneling models allows systems to predict “Default Recurrence.” Oversight mechanisms analyze the “Information Processing Rate” of the agent. A profile that fails to respond to low-friction systemic warnings but reacts aggressively to high-friction liquidity calls exhibits signs of cognitive overload. Therefore, the system interprets this behavioral asymmetry as a precursor to a “Modeled Default.”

The National Bureau of Economic Research (NBER) has published studies on how scarcity affects cognitive bandwidth. Data correlates more strongly with the consistency of decision-making than with the absolute balance on the ledger. Therefore, the systemic review process classifies “Tunneling Behavior”—such as missing low-value administrative tasks while maintaining high-value transactional speed—as a latent risk marker. Profiles that exhibit these markers often face an automatic tightening of their modeled balance-sheet condition until cognitive bandwidth markers stabilize.

The Relief Trap and Behavioral Recurrence

Probability-based auditing identifies specific state transitions when an agent’s behavioral rhythm enters a “Feedback Loop of Necessity.” Within the framework of Cognitive Tunneling, the system monitors for “Recurrence Markers”—patterns where the agent repeatedly falls into the same liquidity traps. Moreover, the oversight mechanism cross-references these patterns with the agent’s digital footprint to ensure the narrative remains consistent with a genuine, manageable lifecycle rather than a descent into systemic insolvency.

In contrast to legacy models, 2026 systems prioritize the “Resilience of Focus.” As a result, agents who attempt to “patch” financial holes through rapid, uncoordinated actions inadvertently trigger a deeper systemic review. This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

Navigating Psychological Baselines

To analyze how systemic review engines weight psychological variance, researchers utilize our resources hub as an analytical modeling aid. Managing the metadata associated with high-stress periods requires an understanding of how behavioral credit auditing shift 2026 logic interprets the stability of the agent’s “Decision-Making Architecture.”

The system favors profiles that demonstrate “Broad-Spectrum Management”—where even during liquidity gaps, long-term obligations remain rhythmic. Moreover, the strategic avoidance of the “Tunneling Response” enhances the profile’s structural integrity. Therefore, maintaining a stable trajectory involves staying outside the Relief Trap, ensuring that the profile projects a calm, long-term financial narrative to the probabilistic evaluation layer.

Conclusion: Awareness as a Stability Metric

The reliance on systemic mechanics to monitor cognitive states confirms a shift in credit reversion behavior. Systems no longer value only the ability to pay; they value the psychological capacity to manage the payment. Consequently, the resilience of a credit profile in 2026 depends on its ability to avoid Cognitive Tunneling, maintaining a multi-layered financial perspective that aligns with the algorithmic expectations of the auditing layer.

Research Abstract

This research explores Cognitive Tunneling as a behavioral risk marker in 2026 credit modeling. It analyzes how systemic oversight mechanisms detect a narrowing of financial focus during stress periods, often leading to the ‘Relief Trap’ and increased probabilistic risk of default recurrence.

| Cognitive State | Behavioral Marker | Probabilistic Impact |

|---|---|---|

| Holistic Planning | Balanced management of short/long-term debt | High structural trust; Tier-1 access |

| Cognitive Tunneling | Exclusive focus on micro-liquidity calls | Risk Marker: Survival Mode; review triggered |

| Relief Trap | Compounding short-term high-interest fixes | State Recognition: Impending Default; latency applied |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.