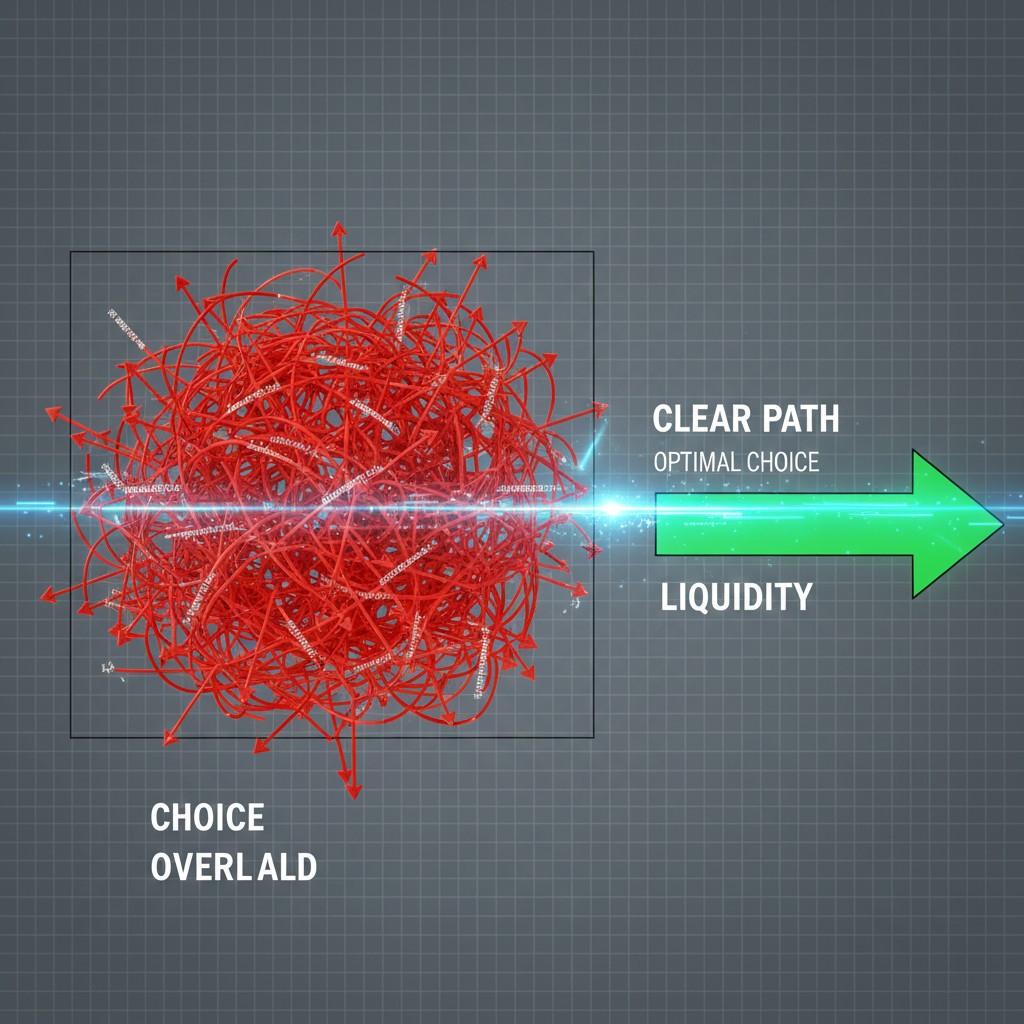

Following our research into Social Scoring Integration: The Proxy Risk of Digital Associations, this study examines Choice Overload as a critical determinant of liquidity efficiency. In the 2026 financial landscape, the proliferation of micro-credit instruments often exceeds human cognitive processing limits. Specifically, this saturation leads to measurable decision paralysis within the risk profile. Institutional audit layers now evaluate how agents navigate these high-density option environments. Consequently, the systems interpret significant hesitation as a precursor to structural instability.

Choice Overload in 2026 Audit Models

Systems define Choice Overload as the cognitive friction resulting from an excessive abundance of similar financial paths. When agents encounter too many competing repayment structures, their probability of selecting a mathematically optimal trajectory decreases. Notably, this phenomenon generates significant “decision noise” that auditors monitor. Subsequently, risk models analyze this noise to predict potential liquidity gaps before they manifest. Indeed, a profile that frequently switches between fragmented tools often exhibits higher behavioral volatility. Therefore, the probabilistic evaluation layer adjusts friction levels based on these observable patterns.

Statistically, institutional data streams track the latency between option presentation and execution. If an agent demonstrates extended hesitation, the model identifies a state of Choice Overload. This condition suggests that the profile lacks a clear, data-driven heuristic for debt management. Furthermore, the system cross-references this behavior with historical utilization velocity. If high fragmentation correlates with decision delay, the algorithm infers a modeled depreciation state. Specifically, this ensures that the credit identity reflects the hidden cognitive cost of managing a complex debt portfolio.

Systemic Mechanics of Decision Paralysis

Decision paralysis serves as a primary behavioral marker for future solvency friction. Agents suffering from saturation often default to the path of least resistance rather than the most efficient settlement. Consequently, this tendency creates a relief trap where immediate ease compromises long-term stability. The 2026 oversight mechanisms effectively capture these suboptimal choices in real-time. Moreover, these mechanisms prioritize systemic integrity over the mere volume of credit utilized.

The Consumer Financial Protection Bureau highlights how complex marketplaces can intentionally obscure the true cost of credit. In response, modern models treat the inability to filter options as a sign of behavioral vulnerability. Conversely, profiles that consolidate their financial obligations into linear pathways face reduced systemic scrutiny. As a result, the risk modeling environment becomes more restrictive for those engaging with excessive market fragmentation. Indeed, structural friction acts as a necessary filter to prevent cognitive exhaustion for the borrower.

Structural Friction and Liquidity Management

Strategic friction serves as a stabilizing force within the 2026 audit layers. When systems detect Choice Overload, they may intentionally limit the available credit options presented to the agent. This intervention serves to streamline the decision architecture and reduce risk. Furthermore, systemic mechanics favor profiles that demonstrate a capacity for high-conviction financial moves. Specifically, these moves include the consistent repayment of a single instrument rather than juggling multiple micro-loans.

In contrast, profiles that maintain a simplified portfolio demonstrate much higher temporal integrity. Managing the metadata associated with complex choices requires a deep understanding of how behavioral credit auditing shift 2026 logic applies. Therefore, understanding these systemic mechanics is essential for modern profile management. Researchers utilize our Resources Hub as a critical analytical modeling aid for these evaluations.

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

The resilience of a credit identity depends on maintaining a clear and direct recovery slope. Profiles avoiding the noise of excessive optionality maintain higher structural integrity over time. Additionally, maintaining a stable trajectory requires recognizing market saturation as a high-friction environment. These signals alert the audit layers to potential cognitive fatigue before default occurs. As a result, agents who prioritize simplicity and execution speed secure a more robust statistical relationship with lending algorithms.

Research Abstract

This study analyzes Choice Overload within the 2026 credit architecture. By examining the cognitive impact of market fragmentation, the research identifies how decision paralysis serves as a leading indicator of liquidity risk. The findings suggest that institutional audit layers now favor simplified, linear debt structures to mitigate behavioral volatility.

| Market Condition | Cognitive State | Systemic Impact |

|---|---|---|

| Consolidated Path | High conviction; rapid execution | Friction reduction; Stability Pass |

| Fragmented Saturation | Decision Noise; Moderate Latency | Overload Alert; Increased Monitoring |

| Extreme Complexity | Complete Paralysis; Relief Trap Default | Modeled Depreciation; Exposure Limit |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.