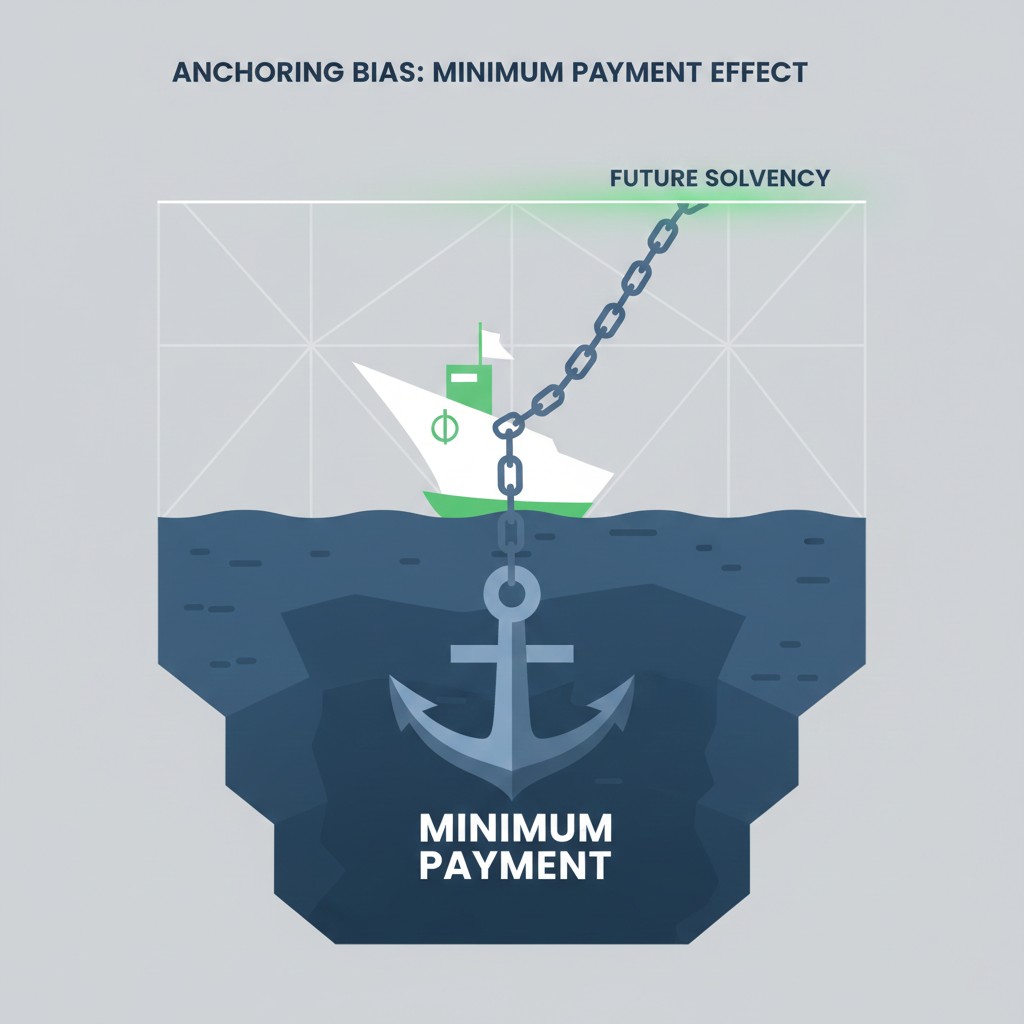

Following our detailed analysis of Choice Overload: Navigating Liquidity in Fragmented Markets, this research explores Anchoring Bias within the 2026 risk modeling framework. In the current behavioral landscape, oversight mechanisms prioritize how agents respond to suggested payment baselines. Specifically, many borrowers anchor their repayment strategy to the minimum required amount. Consequently, this cognitive shortcut often obscures the agent’s true modeled depreciation state. Institutional algorithms interpret this persistent behavior as a signal of latent liquidity friction.

The Mechanics of Anchoring Bias in Credit Auditing

Systems define Anchoring Bias as the disproportionate reliance on the first piece of information offered—in this case, the minimum payment figure. Within 2026 audit layers, this reliance suggests an inability to engage in long-term financial planning. Notably, profiles that consistently meet only the baseline requirement trigger systemic volatility markers. Indeed, the system views this pattern as a failure to optimize the recovery slope. Furthermore, the probabilistic evaluation layer adjusts borrowing friction based on this intertemporal choice.

Statistically, institutional data streams monitor how quickly an agent moves away from an anchor. If a profile exhibits a static relationship with the minimum baseline, it suggests a specific cognitive tunneling state. Moreover, the system cross-references these anchors with high utilization velocity. Subsequently, this combination signals a potential relief trap. To mitigate systemic risk, models introduce defensive latency in new credit extensions. Notably, this structural friction serves as a stabilizing counterweight to impulsive financial heuristics.

Systemic Mechanics of Repayment Baselines

Repayment baselines serve as the primary external reference point for most credit profiles. Agents suffering from bias often view these minimums as a safe harbor rather than a risk floor. However, 2026 oversight mechanisms treat this perception as a behavioral vulnerability. Therefore, the audit layers prioritize agents who demonstrate “de-anchoring” behaviors. These behaviors include making variable payments above the suggested baseline. In contrast, rigid adherence to the anchor triggers increased monitoring within the systemic mechanics.

The Federal Reserve Board continues to analyze how consumer heuristics impact broader economic stability. In particular, models now treat Anchoring Bias as a leading indicator of repayment fragility. Profiles that ignore the long-term cost of interest demonstrate a specific information asymmetry. Consequently, the risk modeling environment becomes more restrictive for these profiles. As a result, the capacity for future credit expansion remains limited until the agent proves a higher valuation of future solvency.

Strategic Friction and Behavioral Correction

Strategic friction acts as a necessary intervention within 2026 audit layers. When systems detect a high-risk anchor, they may modify the presentation of payment options. This intervention aims to reduce the cognitive dominance of the minimum baseline. Furthermore, systemic mechanics favor profiles that exhibit a self-correction trajectory. Specifically, this involves a gradual increase in settlement ratios over multiple audit cycles.

In contrast, profiles that maintain a fixed anchor demonstrate lower temporal integrity. Managing the metadata associated with these choices requires an understanding of how behavioral credit auditing shift 2026 logic applies to specific archetypes. Therefore, understanding these mechanics is essential for modern profile management. Researchers utilize our Resources Hub as an analytical modeling aid for these complex evaluations.

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

The resilience of a credit identity depends on avoiding the cognitive traps set by suggested baselines. Profiles that proactively de-anchor their strategies maintain higher structural integrity. Additionally, maintaining a stable trajectory requires recognizing minimum payments as systemic friction points. These signals alert the audit layers to potential intertemporal instability. As a result, agents who prioritize time-consistent settlements secure a more robust statistical relationship with lending algorithms.

Research Abstract

This study investigates Anchoring Bias as a behavioral risk factor in 2026 credit modeling. It explores how systemic adherence to minimum payment baselines signals cognitive tunneling and reduced intertemporal stability. The research highlights the probabilistic evaluation layers used to detect these anchors and apply defensive structural friction.

| Behavioral State | Anchor Relationship | Systemic Risk Level |

|---|---|---|

| De-Anchored Flow | Variable, high-ratio repayments | Low; Friction reduction |

| Static Anchoring | Strict adherence to minimum baseline | Moderate; Monitoring alert |

| Chronic Tunneling | Persistent baseline settlement + high velocity | High; Defensive latency |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.