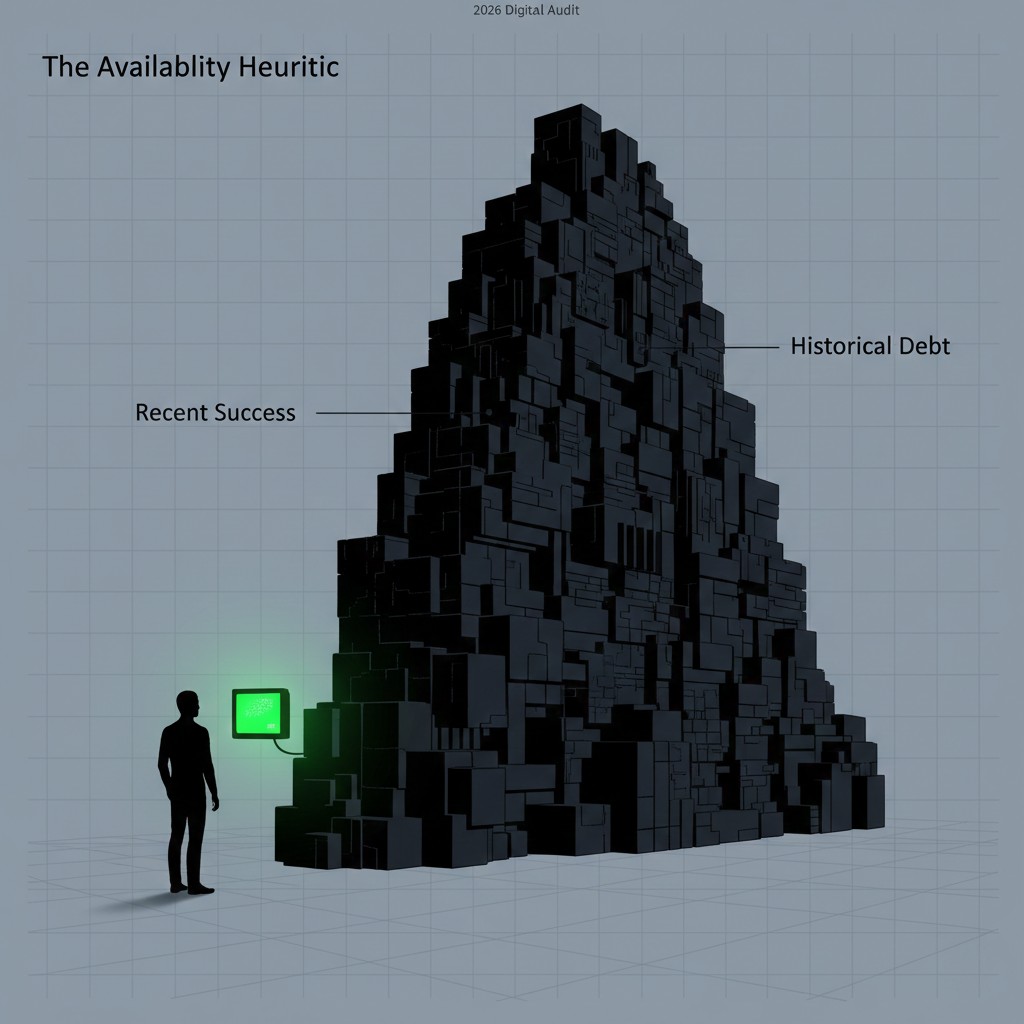

Following our research on Self-Serving Bias: Attributing External Blame for Profile Decay, this study investigates The Availability Heuristic within the 2026 credit architecture. In the current behavioral landscape, oversight mechanisms prioritize how agents weight recent financial events against long-term historical data. Specifically, many profiles overestimate their structural stability because of recent, short-term liquidity peaks. Consequently, this cognitive shortcut leads to a dangerous expansion of debt exposure. Institutional algorithms interpret this reliance on immediate data as a signal of systemic fragility.

The Mechanics of Recency in Risk Auditing

Systems define The Availability Heuristic as a mental shortcut that relies on immediate examples that come to a person’s mind when evaluating a specific topic. Within 2026 audit layers, this manifests as an agent’s tendency to ignore multi-year debt burdens in favor of the last thirty days of successful settlements. Notably, profiles that exhibit high utilization velocity shortly after a single large repayment trigger specific volatility markers. Indeed, the system views this behavior as a failure to recognize the underlying modeled depreciation state. Furthermore, the probabilistic evaluation layer increases friction when agents ignore the statistical probability of a relief trap.

Statistically, institutional data streams monitor the correlation between recent “availability” of funds and subsequent risk-taking. If a profile demonstrates a sudden spike in consumption after a temporary credit line increase, the model identifies a state of cognitive tunneling. Moreover, the system cross-references these short-term surges with the agent’s lifetime default probability. Subsequently, this analysis identifies when an agent is operating under a false sense of stability. Therefore, models may introduce strategic friction by temporarily capping new approvals. Specifically, these interventions aim to protect the system from the fallout of recency-driven optimism.

Systemic Mechanics of Liquidity Overestimation

Liquidity overestimation serves as a critical behavioral filter for risk archetypes in 2026. Specifically, oversight mechanisms observe whether an agent maintains a consistent settlement ratio regardless of recent windfalls. Conversely, profiles that maintain a stable trajectory despite fluctuating monthly incomes receive higher integrity scores. This suggests that the agent is free from the distorting effects of The Availability Heuristic. Therefore, the audit layers prioritize these agents for friction reduction, as they prove a higher capacity for intertemporal stability.

The Bank for International Settlements continues to analyze how behavioral heuristics impact global financial resilience. In particular, modern models treat the “recent stability illusion” as a leading indicator of repayment fragility. If an agent demonstrates a persistent pattern of over-leveraging based on seasonal liquidity, it indicates a high level of information asymmetry. Consequently, the risk modeling environment becomes more restrictive for such profiles. As a result, the capacity for future credit expansion remains limited until the agent proves a higher valuation of long-term solvency over recent gains.

Strategic Friction as a Temporal Anchor

Strategic friction acts as a necessary corrective tool when The Availability Heuristic distorts an agent’s perception of risk. When systems detect a profile is ignoring long-term debt trends, they may initiate a “temporal audit.” This intervention forces the agent to review multi-quarter data before executing new high-value transactions. Furthermore, systemic mechanics favor profiles that exhibit a self-correction trajectory following these data disclosures. Specifically, this involves a measurable shift from reactive spending to proactive liquidity accumulation.

In contrast, profiles that remain anchored to recent successes demonstrate lower temporal integrity. Managing the metadata associated with these psychological shortcuts requires an understanding of how behavioral credit auditing shift 2026 logic applies. Therefore, understanding these mechanics is essential for modern profile management. Researchers utilize our Resources Hub as an analytical modeling aid for these complex evaluations.

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

The resilience of a credit identity depends on maintaining an objective perspective that transcends recent performance. Profiles that proactively account for long-term risk signals maintain higher structural integrity over time. Additionally, maintaining a stable trajectory requires recognizing that recent liquidity is not a substitute for permanent solvency. These signals alert the audit layers to potential cognitive fatigue and over-extension. As a result, agents who prioritize historical data over immediate availability secure a more robust statistical relationship with lending algorithms.

Research Abstract

This study examines The Availability Heuristic as a primary driver of liquidity risk in 2026 credit profiles. By investigating ‘Recency Bias,’ the research identifies how agents who over-leverage based on short-term stability trigger systemic friction. The findings suggest that algorithmic auditors now use longitudinal data comparison to identify and restrict profiles suffering from seasonal optimism.

| Risk Perception State | Behavioral Indicator | Systemic Audit Response |

|---|---|---|

| Long-Term Stability | Consistent utilization regardless of windfall | Friction Reduction; High Integrity |

| Recency Anchored | Aggressive borrowing after 1 payment | Monitoring Alert; Stability Pass Fail |

| Systemic Optimism | Exposure expansion based on peak liquidity | Modeled Depreciation; Defensive Cap |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.