Following our longitudinal study of Revolving Credit Consistency: Behavioral Recurrence Patterns, this research explores Algorithmic Friction as a direct systemic consequence. The previous analysis established that systems value rhythmic, predictable utilization; consequently, any deviation into hyper-velocity repayment cycles triggers a state change in systemic review protocols. This study examines why 2026 institutional frameworks interpret “accelerated amortization” as a potential signal of synthetic identity manipulation or non-institutional liquidity sources.

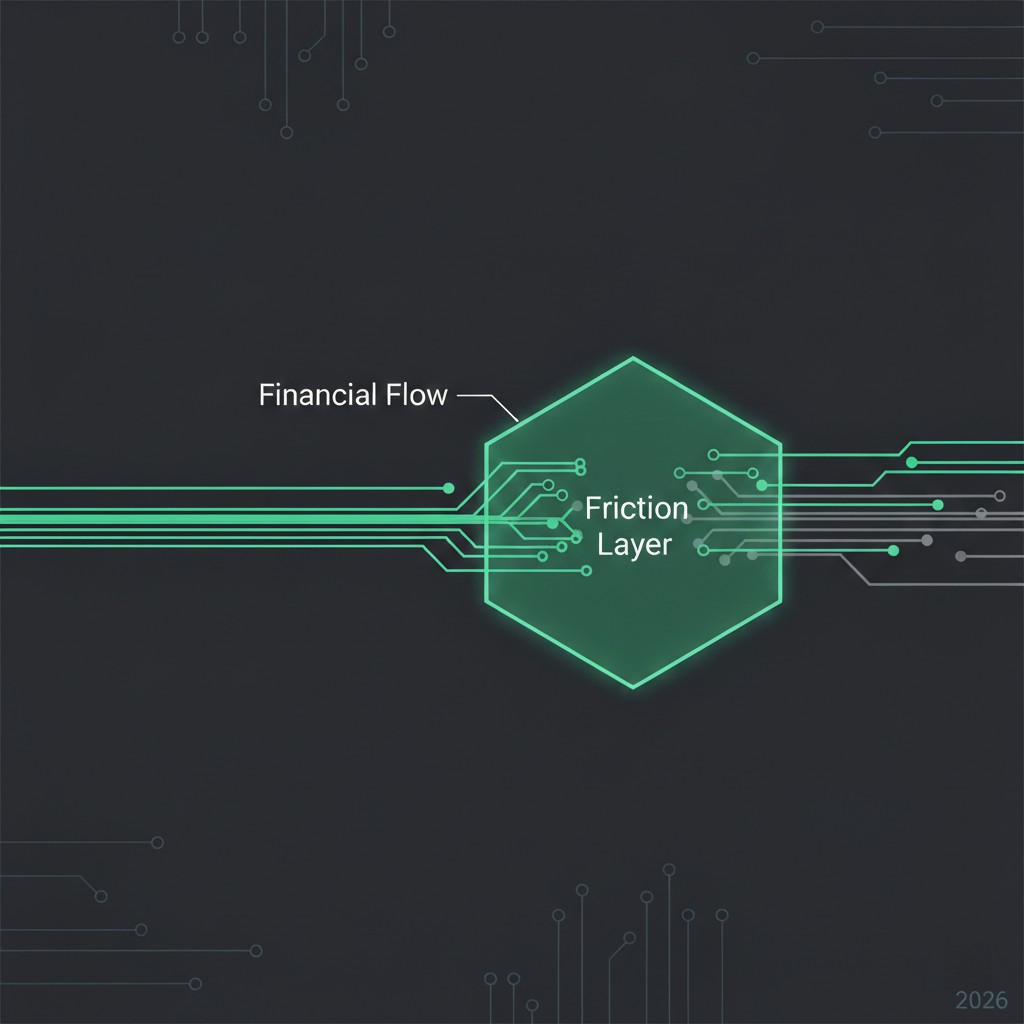

The Mechanics of Algorithmic Friction

In the 2026 institutional landscape, Algorithmic Friction refers to the intentional slowing of credit profile advancement when behavioral data deviates from established socio-economic baselines. Systemic mechanics prioritize “Natural Progression.” When an agent demonstrates a payoff velocity that exceeds their modeled income-to-asset ratio, the oversight mechanism introduces strategic latency. This latency serves to verify the authenticity of the capital flow.

Institutional models utilize metadata flow observation to identify “Amortization Spikes.” For instance, a profile that settles a five-year obligation within six months without a correlated inheritance or capital gains event triggers a state change. The system views this not as financial strength, but as a behavioral anomaly. Consequently, the probabilistic evaluation layer increases the friction coefficient, requiring more extensive transactional mapping to maintain the profile’s reliability state.

Payoff Velocity and Metadata Anomalies

The integration of velocity metrics into Algorithmic Friction models allows systems to detect synthetic behaviors. Oversight mechanisms analyze the “Source of Repayment Metadata.” A profile utilizing rapid cycles of short-duration non-institutional liquidity instruments to settle primary debts often exhibits high market-driven variance. Therefore, the system interprets this hyper-activity as a sign of profile “seasoning”—a tactic used to artificially inflate credit standing.

The Federal Reserve has analyzed how rapid credit expansion and contraction cycles impact systemic stability. Data correlates more strongly with the source consistency of the repayment than with the speed of the repayment itself. Therefore, the systemic review process classifies “unexplained liquidity” as a latent risk marker. Profiles that ignore these baseline expectations face an automatic tightening of their modeled balance-sheet condition until the capital origin is validated.

Synthetic Identity Risk in Rapid Amortization

Probability-based auditing identifies specific state transitions when an agent’s repayment rhythm breaks the expected behavioral recurrence pattern. Within the framework of Algorithmic Friction, the system monitors for “Burst Patterns”—short bursts of high-value settlements followed by total account inactivity. Moreover, the oversight mechanism cross-references these bursts with the agent’s digital footprint to ensure the narrative remains consistent with a genuine human lifecycle.

In contrast to legacy scoring, 2026 models prioritize the “Duration of Exposure.” As a result, agents who attempt to “skip” the maturation phase of a credit profile through rapid payoffs inadvertently trigger a deeper systemic review. This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

Navigating Systemic Baseline States

To analyze how oversight mechanisms weight repayment velocity, researchers utilize our resources hub as an analytical modeling aid. Managing the metadata associated with debt settlement requires an understanding of how behavioral credit auditing shift 2026 logic interprets the speed of financial interactions.

The system favors profiles that demonstrate “Steady-State Amortization.” Moreover, the strategic alignment of payoff events with verifiable income cycles enhances the profile’s structural integrity. Therefore, maintaining a stable trajectory involves avoiding the “Hyper-Velocity Trap,” ensuring that the profile projects a realistic, human-centric financial narrative to the probabilistic evaluation layer.

Conclusion: Velocity as a Variance Marker

The reliance on systemic mechanics to monitor payoff speed confirms a shift in credit reversion behavior. Systems no longer value the fastest repayment; instead, they value the most verifiable repayment. Consequently, the resilience of a credit profile in 2026 depends on its ability to move in sync with institutional expectations, avoiding the Algorithmic Friction triggered by unexplained financial acceleration.

Research Abstract

This research explores Algorithmic Friction as a systemic response to hyper-velocity repayment patterns in 2026 credit models. It analyzes how institutional oversight mechanisms interpret rapid amortization as a marker of synthetic identity risk and examines the probabilistic relationship between payoff velocity and metadata stabilization.

| Repayment Mode | Systemic Marker | Probabilistic Impact |

|---|---|---|

| Steady-State Amortization | Repayment aligns with income cycles | Low friction; normal profile maturation |

| Hyper-Velocity Burst | Sudden debt clearance without metadata basis | Friction coefficient increase; review triggered |

| Non-Institutional Inflow | Repayment via shadow liquidity markers | State Recognition: Synthetic Risk applied |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.