Following our longitudinal study of Algorithmic Credit Mutual Aid, this research explores Algorithmic Isolation in Bankruptcy as a direct systemic consequence. The previous analysis established that networked credit signatures create inter-profile dependencies. Consequently, this study examines how 2026 institutional frameworks employ discrete state recognition to isolate reorganized profiles and anchor specific asset classes within probabilistic evaluation layers.

The Mechanics of Algorithmic Isolation in Bankruptcy

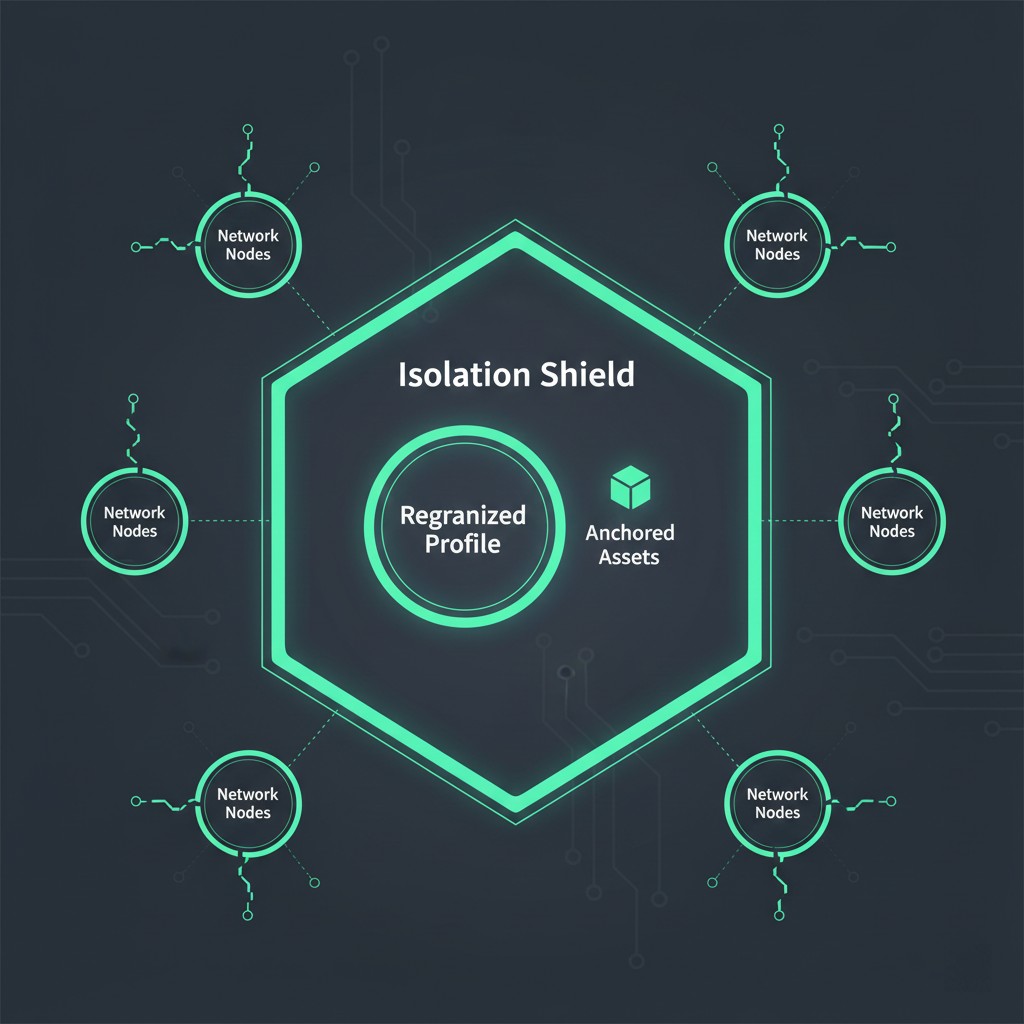

In the 2026 financial environment, Algorithmic Isolation in Bankruptcy represents a systemic guardrail designed to prevent risk contagion. When a profile enters a formal reorganization state, the auditing engine initiates an immediate metadata decoupling. Therefore, the system effectively severs the behavioral links between the bankrupt entity and its previously associated credit nodes.

This isolation process utilizes discrete state recognition to categorize the profile under a restricted evaluation regime. Moreover, the system establishes a digital perimeter around the subject’s remaining liquidity streams. By doing so, the framework ensures that the volatility of the reorganization process does not influence the broader cohort’s structural consistency markers.

Asset Anchoring Logic and Probabilistic Evaluation

Asset anchoring serves as a stabilizing mechanism during the isolation phase. Algorithmic Isolation in Bankruptcy requires the system to lock the valuation of underlying collateral to a fixed historical baseline. As a result, 2026 models ignore speculative market fluctuations for anchored assets. Instead, they focus on the sustained structural integrity of the reorganization plan.

The Bank for International Settlements (BIS) continues to evaluate the effectiveness of these isolation protocols in maintaining macro-prudential stability. Data correlates more strongly with the adherence to the reorganization schedule than with external asset price movements. Consequently, the probabilistic evaluation layer prioritizes long-term balance-sheet conditions over transient liquidity events.

Behavioral Signatures Post-Reorganization

Probability-based auditing identifies specific state transitions as a profile moves through and eventually exits the isolation phase. For instance, the system monitors the emergence of new, organic transactional signatures that demonstrate a high degree of structural consistency. Therefore, Algorithmic Isolation in Bankruptcy is not a permanent state but a calibrated evaluation period.

Moreover, the system interprets the successful maintenance of anchored asset obligations as a primary forward-looking systemic indicator. In contrast, any divergence from the established metadata calibration during this phase triggers an extension of the isolation state. As a result, institutional frameworks reward profiles that demonstrate a predictable and non-volatile recovery trajectory.

Navigating Reorganization States in 2026

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider. To analyze the systemic impact of isolation on credit restoration, observers utilize our resources page as an analytical modeling aid.

Managing the transition out of Algorithmic Isolation in Bankruptcy involves aligning post-reorganization behavior with institutional metadata expectations. Moreover, the system requires evidence of sustained liquidity retention before reducing the isolation weight. Therefore, the strategic management of a reorganized profile requires a deep understanding of how behavioral credit auditing shift 2026 logic evaluates the recovery of structural integrity.

Conclusion: Isolation as a Stability Mechanism

The implementation of Algorithmic Isolation in Bankruptcy confirms a shift toward more granular risk containment strategies in 2026. In contrast to legacy credit models, the current environment treats reorganization as a specific modeled state requiring independent validation. Consequently, the long-term resilience of a bankrupt profile depends on its ability to demonstrate metadata authenticity within an isolated systemic framework.

Research Abstract

Background: This research explores the algorithmic protocols for isolation and asset anchoring during personal bankruptcy reorganization in 2026. It identifies how AI models utilize discrete state recognition to decouple bankrupt profiles from credit networks, focusing on the probabilistic evaluation of reorganization adherence and the structural consistency of post-isolation metadata.

| Operational Phase | Systemic Action | Asset Status | Audit Focus |

|---|---|---|---|

| Initial Decoupling | Network Link Severance | Anchored to Baseline | Contagion prevention |

| Active Isolation | Restricted Metadata Evaluation | Probabilistic Lockdown | Reorganization adherence |

| Conditional Re-entry | Gradual Network Integration | Dynamic Recalibration | Structural consistency validation |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.