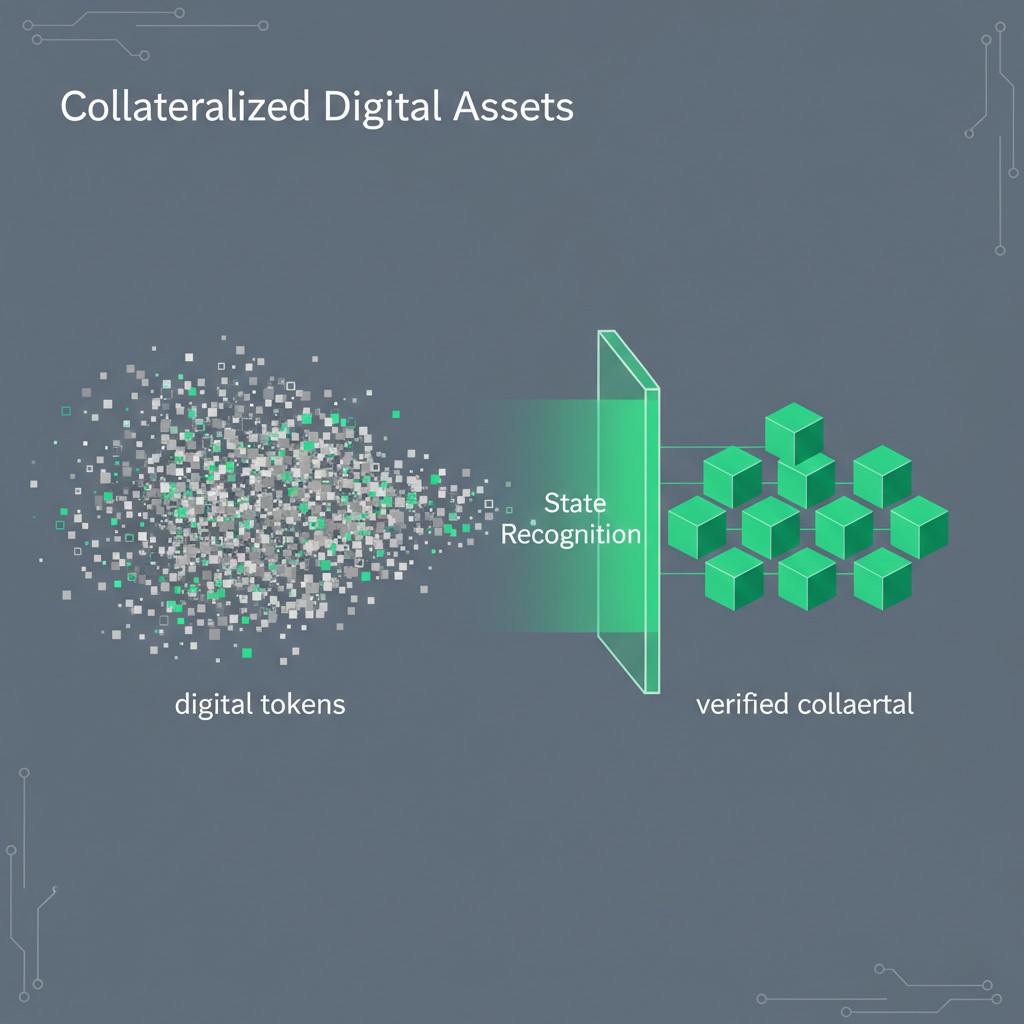

Following our longitudinal study of Algorithmic Friction: 2026 Mechanics, this research explores Collateralized Digital Assets as a direct systemic consequence. The previous analysis demonstrated how rapid repayment velocity triggers friction; conversely, the source of that liquidity—specifically when derived from digital ledgers—undergoes rigorous state recognition. Therefore, this study examines how 2026 institutional frameworks classify digital holdings not as speculative instruments, but as verifiable liquidity buffers within a modeled credit profile.

State Recognition in Digital Asset Auditing

In the 2026 auditing landscape, Collateralized Digital Assets refer to tokenized holdings that meet specific “Stability Thresholds” set by institutional oversight mechanisms. Unlike unverified wallet inflows, which systems often flag as high-variance noise, collateralized assets are recognized as having “Structural Density.” This means the system can verify the asset’s historical liquidity depth and its correlation with stable market indices.

Institutional models utilize metadata flow observation to distinguish between “Speculative Volatility” and “Collateral Utility.” For instance, if an agent links a digital wallet containing stable-value tokens with a 24-month transaction history of low volatility, the probabilistic evaluation layer assigns a “Tier-2 Asset Class” marker. This marker allows the digital asset to function as a counterweight to other liabilities, reducing the overall risk profile calculation.

Volatility Dampening and Liquidity Scoring

The integration of blockchain metadata into Collateralized Digital Assets evaluation requires a sophisticated understanding of “Volatility Dampening.” Oversight mechanisms analyze the holding duration and the transfer velocity of the digital portfolio. A profile that exhibits “High-Frequency Rotation”—constantly swapping assets—signals a lack of collateral stability. Consequently, the system classifies these holdings as “Transient Capital,” excluding them from long-term solvency models.

The Bank for International Settlements (BIS) has outlined frameworks for the prudential treatment of crypto-asset exposures. Data correlates more strongly with the custodial clarity of the asset than with its absolute market value. Therefore, the system rewards agents who maintain digital assets in recognized, audit-compatible environments with higher “Liquidity Confidence Scores,” treating them similarly to traditional securities.

Discrete State Recognition in Hybrid Portfolios

Probability-based auditing identifies specific state transitions when digital assets move between storage and utilization states. Within the framework of Collateralized Digital Assets, the system monitors for “Liquidity Bridging”—the act of converting digital value into fiat for debt service. Moreover, the oversight mechanism cross-references the timestamp of the conversion with the repayment event to ensure the capital flow is organic and not artificially cycled.

In contrast to legacy views that dismissed digital assets entirely, 2026 models prioritize the “Traceability of Value.” As a result, agents who utilize digital assets as static collateral anchors rather than active trading vehicles maintain a more stable statistical relationship with lending algorithms. This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

Navigating Digital Asset Integration

To analyze how systemic review engines weight digital portfolios, researchers utilize our resources hub as an analytical modeling aid. Managing the metadata associated with digital holdings requires an understanding of how behavioral credit auditing shift 2026 logic interprets the permanence of non-fiat wealth.

The system favors profiles that isolate their Collateralized Digital Assets from high-risk transactional layers. Moreover, the strategic use of “Read-Only” API permissions allows the oversight mechanism to verify solvency without triggering security flags. Therefore, maintaining a stable trajectory involves presenting digital assets as “Dormant Reserves” rather than active operational capital.

Conclusion: From Speculation to Structure

The reliance on systemic mechanics to evaluate digital wealth confirms a shift in credit reversion behavior. Systems no longer view all digital assets as risk vectors; instead, they filter for stability and custodial transparency. Consequently, the resilience of a credit profile in 2026 depends on the ability to transform digital holdings into recognized Collateralized Digital Assets, thereby integrating them into the legitimate financial identity.

Research Abstract

This study analyzes the classification of Collateralized Digital Assets within 2026 systemic auditing frameworks. It explores how AI models utilize “State Recognition” to differentiate between transient speculative tokens and stable, verifiable digital liquidity buffers that contribute to profile solvency.

| Asset State | Systemic Marker | Probabilistic Impact |

|---|---|---|

| Verified Collateral | High stability; audit-compatible custody | Tier-2 Asset recognition; solvency boost |

| Transient Capital | High-frequency rotation; volatility spikes | Excluded from solvency models; noise filtered |

| Unverified Inflow | Opaque source; rapid fiat conversion | Risk Marker: Liquidity Bridging Review |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.