Following our longitudinal study of Algorithmic Isolation in Bankruptcy, this research explores Digital Footprint Correlations as a direct systemic consequence. The previous analysis established that isolation protocols sever traditional credit links, creating a data vacuum. Consequently, this study examines how 2026 institutional frameworks turn to unstructured digital metadata to calibrate the probabilistic integrity of “thin-file” or reorganized profiles.

The Mechanics of Digital Footprint Correlations

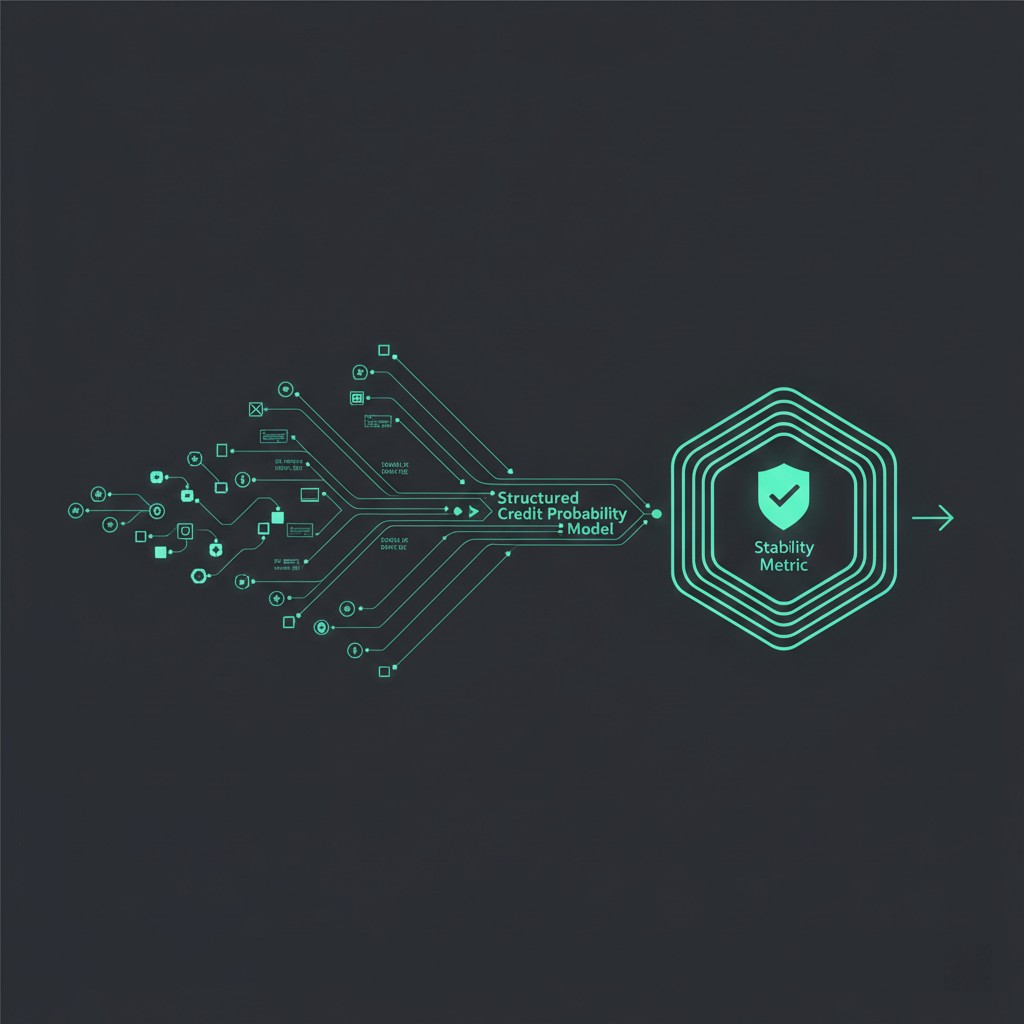

In the 2026 auditing environment, Digital Footprint Correlations refer to the statistical mapping of non-financial digital behaviors to credit solvency markers. Unlike traditional ledger data, digital footprints—ranging from login timestamp consistencies to device stability metrics—serve as a proxy for structural consistency. Therefore, models interpret highly fragmented digital behavior as a potential latent risk marker.

The system utilizes metadata calibration to verify the authenticity of an agent’s digital presence. Moreover, these analytical models detect anomalies where the velocity of digital interaction does not align with the reported lifestyle or income stability. When such a divergence is identified, the system adjusts the modeled reliability state without necessarily accessing the content of the interactions.

Unstructured Data and Probabilistic Evaluation

The integration of unstructured data shifts the focus from transactional volume to behavioral interaction flow. Digital Footprint Correlations allow oversight mechanisms to conduct probability-based auditing on profiles that lack deep credit history. As a result, a stable, long-term digital identity often correlates with lower default probabilities than a newly generated, sterile digital persona.

The Federal Reserve has noted the macro-prudential implications of using alternative data in credit decisioning. Data correlates more strongly with the consistency of digital access points than with the specific platforms used. Consequently, the probabilistic evaluation layer classifies “digital ghosting”—the sudden scrubbing or absence of expected metadata trails—as a sign of potential synthetic identity manipulation.

Behavioral Recurrence in Digital Metadata

Systemic review engines identify specific behavioral recurrence patterns within the digital footprint. For instance, regular, predictable interaction times with financial apps suggest a structured financial life. Therefore, Digital Footprint Correlations function as a forward-looking systemic indicator. The system classifies agents based on the entropy of their digital signals; high entropy often triggers a tighter credit friction setting.

Moreover, the system interprets the alignment between physical geolocation metadata and digital activity logs. In contrast to manual verification, this automated cross-referencing provides a continuous validation layer. As a result, profiles that demonstrate high coherence between their physical and digital states maintain a more robust statistical relationship with lending algorithms.

Navigating the Digital-Financial Nexus

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider. To understand the systemic weight of these digital signals, researchers utilize our resources page as an interpretive modeling aid.

Managing systemic mechanics involving digital signals involves maintaining a natural, organic digital presence that aligns with one’s financial narrative. Moreover, the system favors longevity and stability in device and network usage. Therefore, the strategic management of a credit profile in 2026 requires an understanding of how behavioral credit auditing shift 2026 logic interprets the silence or noise within one’s digital exhaust.

Conclusion: Metadata as the New Collateral

The reliance on structural friction dynamics signals a transition toward “Behavioral Collateral.” In contrast to static asset pledging, the 2026 system values the continuous stream of consistent metadata. Consequently, the resilience of a credit profile depends on its ability to project a stable, non-chaotic digital shadow that reinforces the structural integrity of the primary credit file.

Research Abstract

This research analyzes the integration of unstructured digital metadata into 2026 credit risk models. It explores how Digital Footprint Correlations are used to calibrate probability-based auditing for profiles with limited financial history, focusing on the systemic interpretation of behavioral consistency and digital entropy.

| Metadata Type | Stable Correlation (Low Risk) | Systemic Impact |

|---|---|---|

| Device Stability | Long-term Primary Device | Identity verification friction reduced |

| Network Patterns | Consistent Geo-IP Clusters | Probabilistic evaluation baseline met |

| Digital Entropy | Predictable Activity Cycles | Latent risk marker avoided |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.