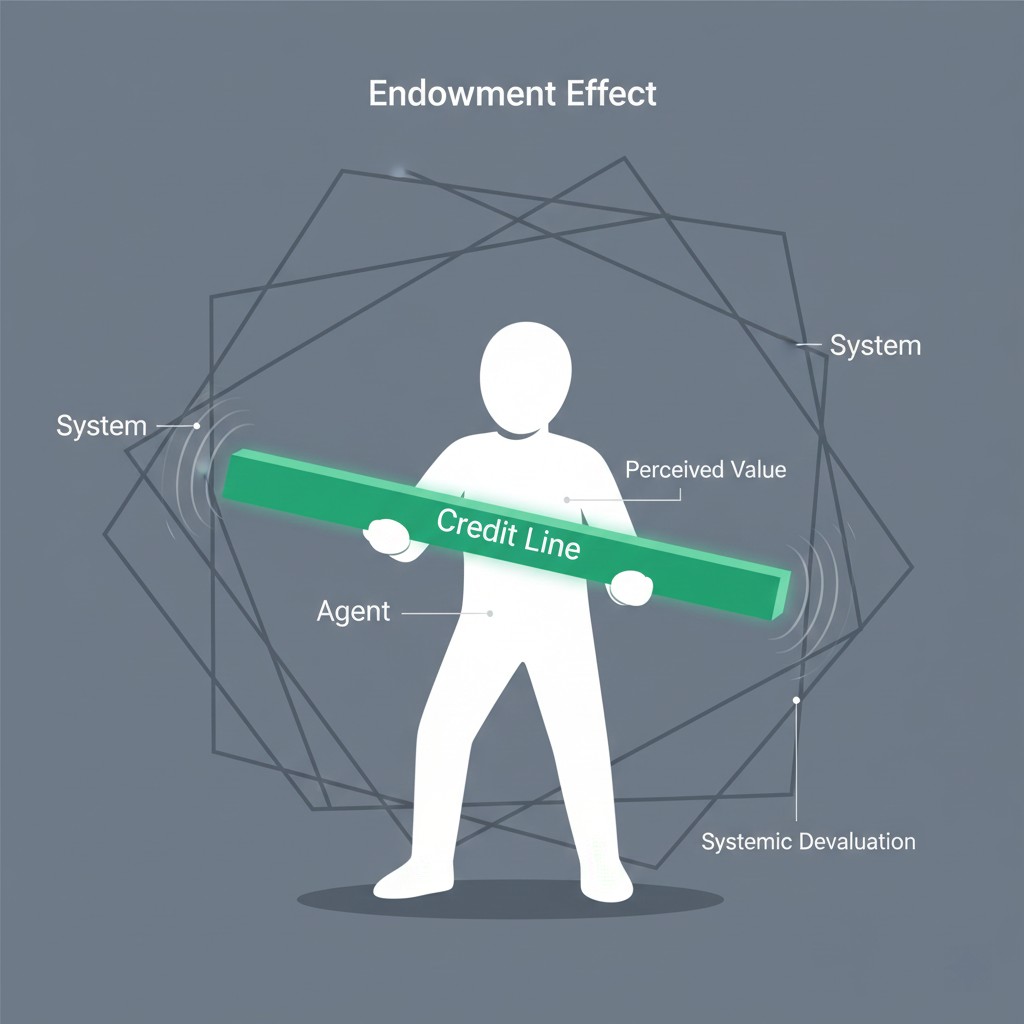

Following our longitudinal study of Cognitive Tunneling: The Psychology of Default States, this research explores the Endowment Effect as a primary systemic mapping in debt management. The previous analysis established that financial stress funnels decision-making into narrow survival paths; conversely, once an agent is granted a specific credit limit, their psychological architecture tends to internalize this capacity as a “personal asset” rather than a conditional systemic permission. This study examines how 2026 institutional frameworks interpret the irrational defense of these limits as a marker of structural fragility.

The Mechanics of the Endowment Effect in Credit

In the 2026 institutional landscape, the Endowment Effect manifests as the tendency for agents to overvalue their existing credit lines, leading to a disproportionate negative behavioral deviation when those lines are adjusted downward during “Dynamic Scaling.” Systemic mechanics prioritize liquidity equilibrium; however, when auditing layers reduce a limit due to shifting market variance, the agent often perceives this as a direct loss of personal wealth.

Institutional models utilize metadata flow observation to identify “Limit Defense” signatures. For instance, a profile that suddenly increases its utilization ratio immediately following a credit limit reduction—attempting to “lock in” the remaining liquidity—triggers a specific state recognition protocol. The system views this not as a strategic maneuver, but as an irrational应激 response driven by Loss Aversion. Consequently, the probabilistic evaluation layer increases the friction coefficient, marking this lack of adaptive resilience as a high-risk exposure.

Limit Defense and Risk Volatility

The integration of emotional variance markers into Endowment Effect models allows systems to detect “Aggressive Reciprocity.” Oversight mechanisms analyze the agent’s transactional feedback to systemic adjustments. A profile that initiates retaliatory spending or makes multiple high-intensity inquiries to secondary liquidity sources immediately after a limit adjustment exhibits high market-driven variance. Therefore, the system interprets this as a sign of “Structural Instability,” assuming the agent lacks a sufficient non-credit liquidity buffer.

The Journal of Behavioral Finance has analyzed how the perception of “owned” credit impacts debt-service ratios. Data from 2026 correlates more strongly with the reaction to the adjustment than with the absolute limit itself. The systemic review process classifies “Retaliatory Utilization”—the act of exhausting a reduced line—as an acute risk marker. Profiles that ignore the logic of the recalibration face an automatic tightening of their modeled environment until the behavioral noise returns to the baseline.

Discrete State Recognition in Ownership Bias

Probability-based auditing identifies specific state transitions when an agent’s ownership bias disrupts their financial narrative. Within the framework of the Endowment Effect, the system monitors for “Inertia of Expectations”—where the agent continues to model their consumption on a legacy limit that no longer exists. Moreover, the oversight mechanism cross-references these patterns with the agent’s digital footprint to detect signs of psychological defense that may lead to secondary default cycles.

In contrast to legacy models that focused purely on repayment records, 2026 systems prioritize “Adaptability.” As a result, agents who exhibit a cold, non-reactive state during limit adjustments maintain a more robust statistical relationship with lending algorithms. This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

Navigating Perception-Based Auditing

To analyze how systemic review engines weight behavioral reactions, researchers utilize our resources hub as an analytical modeling aid. Managing the metadata associated with limit adjustments requires an understanding of how behavioral credit auditing shift 2026 logic evaluates the “Elasticity of the Agent.”

The system favors profiles that demonstrate “Rational De-leveraging”—where a reduction in credit capacity is met with a corresponding reduction in discretionary outflows. Moreover, the strategic avoidance of “Limit Defense” maneuvers enhances the profile’s structural integrity. Therefore, maintaining a stable trajectory involves recognizing credit as a fluid systemic tool rather than a static personal endowment.

Conclusion: Psychological Detachment as a Stability Metric

The reliance on systemic mechanics to monitor behavioral responses confirms a shift in credit reversion behavior. Systems no longer value only the agent’s income level; they value the agent’s psychological detachment from their credit lines. Consequently, the resilience of a credit profile in 2026 depends on its ability to avoid the Endowment Effect, ensuring that every systemic adjustment is met with a rational, data-driven recalibration that preserves the profile’s long-term viability.

Research Abstract

This study analyzes the Endowment Effect within 2026 credit line management frameworks. By observing “Limit Defense” and “Loss Aversion” behaviors during credit capacity adjustments, it explores how AI auditing systems convert psychological reactions into probabilistic risk weights. The research concludes that behavioral adaptability is now a core metric for structural profile integrity.

| Response Mode | Systemic Marker | Probabilistic Impact |

|---|---|---|

| Rational De-leveraging | Outflows contract in sync with limit reduction | High Adaptive Resilience; friction reduced |

| Limit Defense | Sudden utilization spike post-reduction | Loss Aversion marker; status: Observation |

| Aggressive Reciprocity | Simultaneous inquiries and retaliatory spending | State Recognition: Structural Fragility; latency applied |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.