Following our longitudinal study of The Endowment Effect in Credit Line Management, this research explores Hyperbolic Discounting as a direct systemic consequence. In the 2026 credit landscape, oversight mechanisms prioritize how agents value immediate utility against future solvency. Profiles exhibiting a high frequency of deferred payments often trigger specific temporal instability markers. These markers suggest a mathematical decay in the agent’s valuation of future credit sovereignty. Therefore, institutional frameworks treat these choices as observable behavioral risks.

Hyperbolic Discounting and Systemic Mechanics

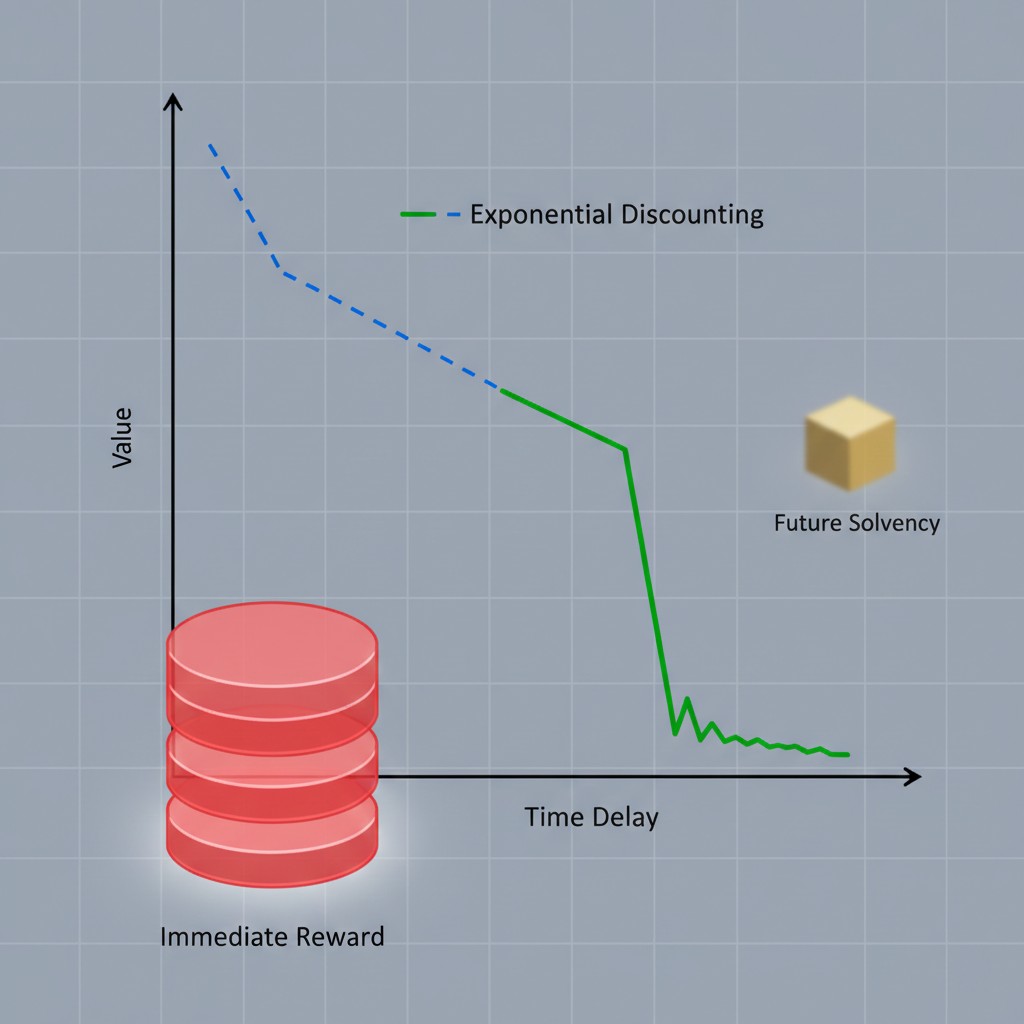

Systems define Hyperbolic Discounting as the tendency to choose smaller, immediate rewards over larger, delayed rewards. Within credit markets, this manifests as a preference for micro-installments over immediate settlement. This behavior persists even when liquidity is present. Audit models analyze this recurrence to predict future repayment consistency. A profile prioritizing current consumption through fragmented structures often exhibits a higher risk of future liquidity gaps. Consequently, the probabilistic evaluation layer adjusts friction levels based on these temporal preferences.

Institutional data streams monitor the time-inconsistency of borrower preferences. When a profile utilizes deferred payment for low-value goods, it signals a specific cognitive state. This state suggests that the agent may struggle with future debt-service obligations. Moreover, the system cross-references these patterns with historical stability markers. This ensures a comprehensive view of the agent’s temporal decision-making process. Information asymmetry between the borrower and the model often obscures the long-term modeled depreciation state.

Behavioral Recurrence Patterns in Deferred Payments

Credit reversion behavior indicates how quickly a profile returns to a baseline state after high utilization. Agents exhibiting high levels of present bias often show a slower return to stability. They accumulate micro-debts that bypass traditional debt-to-income caps. However, the 2026 oversight mechanisms effectively capture these fragmented liabilities. These mechanisms prioritize systemic integrity over simple balance sheet snapshots. This detection helps mitigate the relief trap associated with temporary liquidity injections.

The Consumer Financial Protection Bureau continues to investigate the risks associated with lack of transparency in installment markets. Models now treat persistent deferment as a primary indicator of behavioral volatility. Profiles with high utilization velocity across multiple platforms face increased systemic scrutiny. As a result, the risk modeling environment becomes more restrictive until the profile stabilizes. Systematic friction acts as a necessary counterweight to cognitive tunneling during periods of high consumption.

Structural Friction as a Defensive Response

Structural friction serves as a defensive mechanism within 2026 audit layers. When systems detect a shift toward hyperbolic decay, they introduce latency in new credit approvals. This latency serves to counteract impulsive consumption narratives. Systemic mechanics favor profiles that demonstrate delayed gratification markers. These markers include long periods of liquidity accumulation before high-value purchases. This behavior correlates with higher intertemporal stability.

In contrast, profiles that maintain steady settlement rhythms demonstrate higher temporal integrity. Managing the metadata associated with deferred payments requires an understanding of how behavioral credit auditing shift 2026 logic applies to various spending archetypes. Therefore, understanding these mechanics is essential for profile management. Researchers utilize our Resources Hub as an analytical modeling aid for these evaluations.

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

The resilience of a credit identity depends on maintaining a consistent recovery slope. Profiles avoiding fragmented debt structures maintain higher structural integrity. Maintaining a stable trajectory requires recognizing deferred payments as high-friction signals. These signals alert the audit layers to potential temporal instability. As a result, agents who prioritize time-consistent payments secure a more robust statistical relationship with lending algorithms.

Research Abstract

This study examines Hyperbolic Discounting as a behavioral risk factor in 2026 credit auditing. By analyzing BNPL penetration, it explores how AI-driven models identify ‘Temporal Preference Disorder’—a state where immediate utility outweighs future solvency, triggering systemic risk markers and friction adjustments.

| Temporal State | Behavioral Marker | Probabilistic Impact |

|---|---|---|

| Linear Planning | Immediate settlement; rhythmic savings | High integrity; friction reduction |

| Temporal Fragmentation | High BNPL frequency; micro-debt stacking | Present Bias alert; status: Warning |

| Hyperbolic Decay | Concurrent deferred obligations | Preference Disorder; defensive latency |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.