Following our longitudinal study of Student Loan Auditing, this research explores Medical Debt Probabilistic Evaluation as a direct systemic consequence. The previous analysis demonstrated how long-term educational debt creates cognitive tunneling; however, health-related liabilities function as stochastic liquidity shocks rather than planned amortizations. Therefore, this study examines how 2026 institutional frameworks calibrate these random variables within the broader context of systemic resilience.

The Mechanics of Medical Debt Probabilistic Evaluation

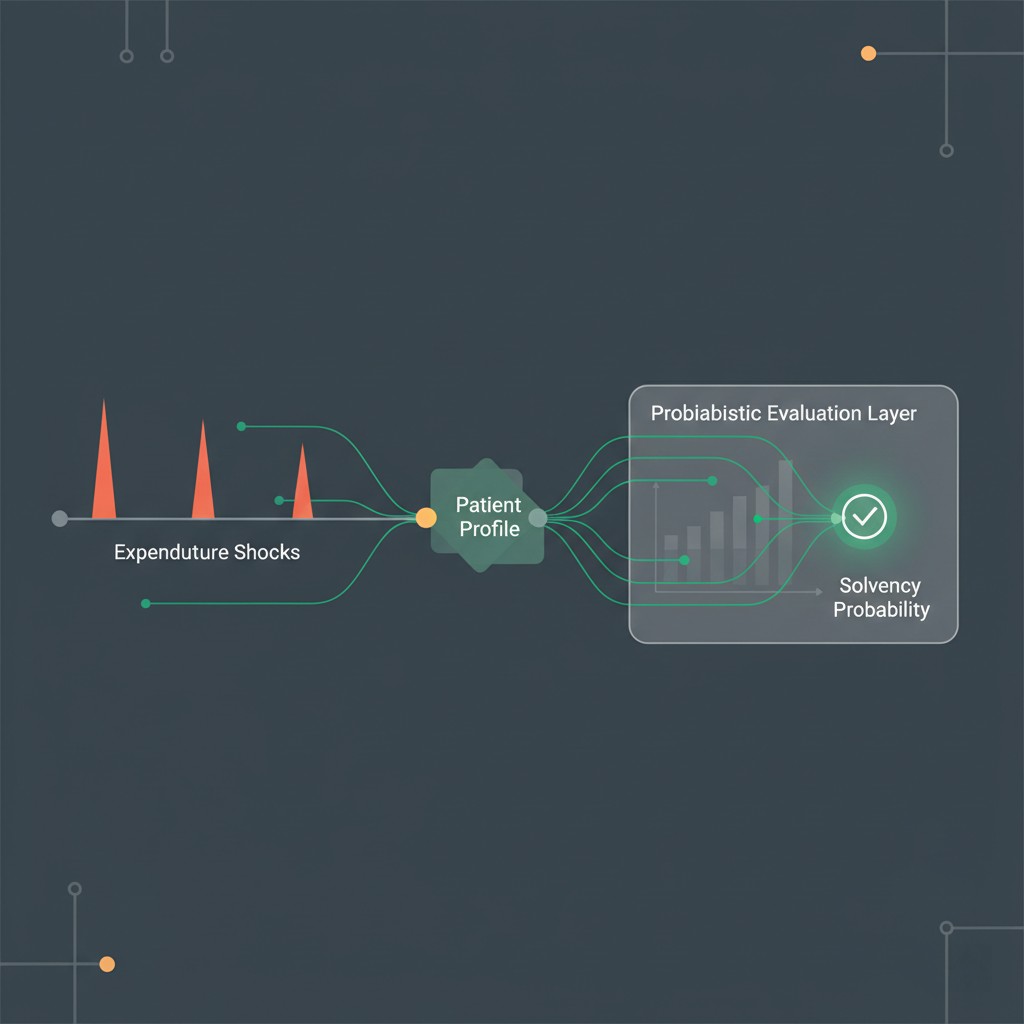

In the 2026 auditing landscape, Medical Debt Probabilistic Evaluation treats healthcare liabilities as “exogenous shocks.” Unlike consumer-driven credit expansion, the system classifies medical metadata as a non-discretionary volatility event. Systemic mechanics prioritize identifying the “Recovery Slope”—the statistical speed at which an agent’s cash flow returns to a modeled balance-sheet condition following a health-related expenditure.

Institutional models utilize metadata flow observation to distinguish between a transient medical shock and structural insolvency. For instance, if the agent maintains structural consistency in other credit domains during the medical event, the probabilistic evaluation layer may apply a “Volatility Buffer.” This buffer prevents the immediate triggering of aggressive credit friction, recognizing the discrete nature of the liability.

Stochastic Shocks and Behavioral Recurrence

The integration of health-related variables into Medical Debt Probabilistic Evaluation requires a sophisticated understanding of behavioral recurrence patterns. Oversight mechanisms analyze whether a medical liability leads to a contagion-like propagation across revolving credit lines. Consequently, the system monitors the coherence of secondary financial signals during the medical recovery period to see if the agent enters a relief-seeking recurrence pattern.

The Consumer Financial Protection Bureau (CFPB) has emphasized the need for neutral treatment of medical obligations in systemic reviews. Data correlates more strongly with the duration of the liquidity gap than with the specific medical provider involved. Therefore, the system classifies agents who exhibit rapid “Metadata Stabilization” as possessing high systemic resilience, even if the absolute medical balance remains on the ledger.

Discrete State Recognition in Healthcare Liabilities

Probability-based auditing identifies specific state transitions when medical metadata enters the credit ecosystem. Within the framework of Medical Debt Probabilistic Evaluation, the system monitors for “Latent Risk Markers,” such as the sudden utilization of high-interest payday tools to settle medical arrears. Moreover, the oversight mechanism cross-references insurance claim metadata with repayment velocity to ensure the modeled reliability state remains accurate.

In contrast to legacy scoring, 2026 models prioritize the “Inertia of Solvency.” As a result, agents who demonstrate an organized approach to medical debt reorganization—leveraging institutional payment plans rather than unmanaged defaults—maintain a more stable statistical relationship with lending algorithms. This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

Navigating Health-Related Financial Inflection Points

To analyze how systemic review engines weight medical liabilities, researchers utilize our resources hub as an analytical modeling aid. Managing the metadata associated with healthcare debt requires an understanding of how behavioral credit auditing shift 2026 logic evaluates the recovery trajectory of a profile.

The system favors profiles that isolate the medical shock from their primary credit operations. Moreover, the strategic use of HSA (Health Savings Account) metadata flows can enhance the profile’s structural integrity by signaling forward-looking risk management. Therefore, maintaining a stable trajectory in Medical Debt Probabilistic Evaluation involves projecting an image of managed recovery rather than broad systemic distress.

Conclusion: Resilience in the Face of Stochasticity

The reliance on systemic mechanics to evaluate medical debt confirms a shift in credit reversion behavior. Systems no longer view healthcare liabilities as definitive markers of financial failure; instead, they function as test cases for an agent’s systemic resilience. Consequently, the long-term stability of a credit profile in 2026 depends on the ability to absorb exogenous shocks without compromising the structural consistency of the entire financial persona.

Research Abstract

This study analyzes the probabilistic evaluation of medical debt as a stochastic liquidity shock within 2026 credit models. It identifies the “Recovery Slope” as a primary systemic marker and explores how AI-driven oversight mechanisms differentiate between transient healthcare-related volatility and structural insolvency to maintain model accuracy.

| Shock Type | Systemic Marker | Probabilistic Impact |

|---|---|---|

| Isolated Medical Shock | Single-source liability; high stability elsewhere | Volatility Buffer applied; no friction increase |

| Contagion-like Pattern | Health shock leads to secondary defaults | Discrete state recognition: Structural Friction |

| Managed Recovery | Formal payment plan metadata flow | Structural consistency score maintained |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.