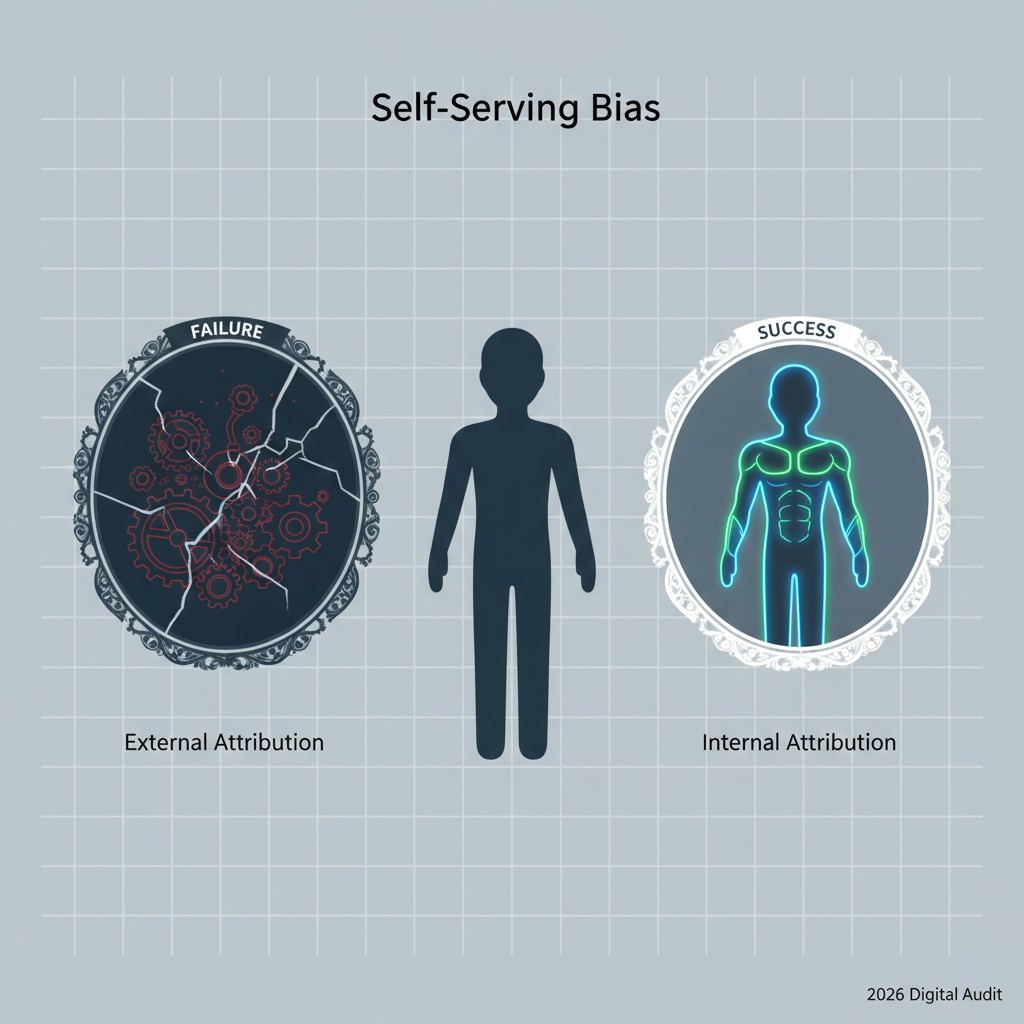

Following our research on Confirmation Bias: The Peril of Selective Financial Monitoring, this study investigates Self-Serving Bias within the 2026 credit auditing framework. In the current systemic environment, oversight mechanisms analyze how agents attribute their financial outcomes. Specifically, many profiles demonstrate a tendency to credit internal discipline for stability while blaming external factors for decay. Consequently, this cognitive distortion prevents an accurate assessment of the agent’s actual modeled depreciation state. Institutional algorithms interpret this displacement of responsibility as a significant marker of systemic fragility.

The Mechanics of Self-Serving Bias in Risk Auditing

Systems define Self-Serving Bias as the propensity to attribute positive events to one’s character but negative events to external circumstances. Within 2026 audit layers, this manifests as agents attributing a high credit score to their intelligence. Conversely, they may blame “algorithmic glitches” or “market volatility” for a sudden increase in utilization velocity. Notably, profiles exhibiting this disconnect trigger specific behavioral volatility markers. Indeed, the system views the externalization of blame as a refusal to adjust internal settlement rhythms. Furthermore, the probabilistic evaluation layer increases friction when agents ignore the causal link between consumption and risk.

Statistically, institutional data streams monitor how agents interact with customer support during profile downgrades. If a profile repeatedly disputes valid late-payment markers by citing “technical errors,” the model identifies a state of cognitive evasion. Moreover, the system cross-references these disputes with historical utilization patterns. Subsequently, this analysis helps detect a relief trap where the agent avoids behavioral correction by blaming the infrastructure. Therefore, models may introduce mandatory accountability modules before restoring previously held credit limits. Specifically, these interventions ensure the agent acknowledges their role in the profile’s recovery slope.

Systemic Mechanics of Responsibility Attribution

Responsibility attribution serves as a secondary behavioral filter for risk archetypes in 2026. Specifically, oversight mechanisms observe whether an agent accepts the consequences of high-velocity spending. Profiles that demonstrate an immediate “internalized” response—such as reducing consumption after a warning—receive higher stability scores. This suggests that the agent is free from debilitating Self-Serving Bias. Therefore, the audit layers prioritize these agents for friction reduction, as they prove a higher capacity for self-regulated intertemporal stability.

The Federal Reserve Board continues to analyze how psychological externalization impacts systemic economic resilience. In particular, modern models treat the habitual blaming of “high interest rates” for personal liquidity gaps as a leading indicator of fragility. If an agent demonstrates a persistent pattern of responsibility evasion, it indicates a high level of information asymmetry. Consequently, the risk modeling environment becomes more restrictive for such profiles. As a result, the capacity for future credit expansion remains limited until the agent demonstrates a realistic internal attribution heuristic.

Strategic Friction as an Accountability Anchor

Strategic friction acts as a necessary corrective tool when Self-Serving Bias distorts an agent’s financial reality. When systems detect a profile is deflecting blame for a modeled depreciation state, they may restrict access to dispute mechanisms. This intervention aims to focus the agent’s attention on internal behavioral adjustments rather than external grievances. Furthermore, systemic mechanics favor profiles that exhibit a self-correction trajectory after a period of volatility. Specifically, this involves a measurable shift from reactive blaming to proactive settlement ratio optimization.

In contrast, profiles that maintain a narrative of external victimhood demonstrate lower temporal integrity. Managing the metadata associated with these psychological defense mechanisms requires an understanding of how behavioral credit auditing shift 2026 logic applies. Therefore, understanding these mechanics is essential for modern profile management. Researchers utilize our Resources Hub as an analytical modeling aid for these complex evaluations.

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider.

The resilience of a credit identity depends on maintaining a transparent and internalized relationship with financial data. Profiles that proactively accept and address internal risk signals maintain higher structural integrity over time. Additionally, maintaining a stable trajectory requires recognizing that blaming the system increases systemic friction. These signals alert the audit layers to potential psychological blind spots. As a result, agents who prioritize internal accountability secure a more robust statistical relationship with lending algorithms.

Research Abstract

This study examines Self-Serving Bias as a psychological hurdle in 2026 credit profile management. By investigating the ‘Externalization of Blame,’ the research identifies how agents who attribute profile decay to system errors trigger defensive audit friction. The findings suggest that algorithmic auditors now prioritize ‘Responsibility Attribution’ as a core metric for determining long-term solvency.

| Attribution Archetype | Behavioral Marker | Systemic Outcome |

|---|---|---|

| Internal Accountability | Corrective action after downgrades | Friction Reduction; High Integrity |

| Moderate Externalizer | Occasional blaming of external rates | Monitoring Alert; Stability Check |

| Systemic Deflector | Chronic disputes citing technical error | Defensive Latency; Access Restriction |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.