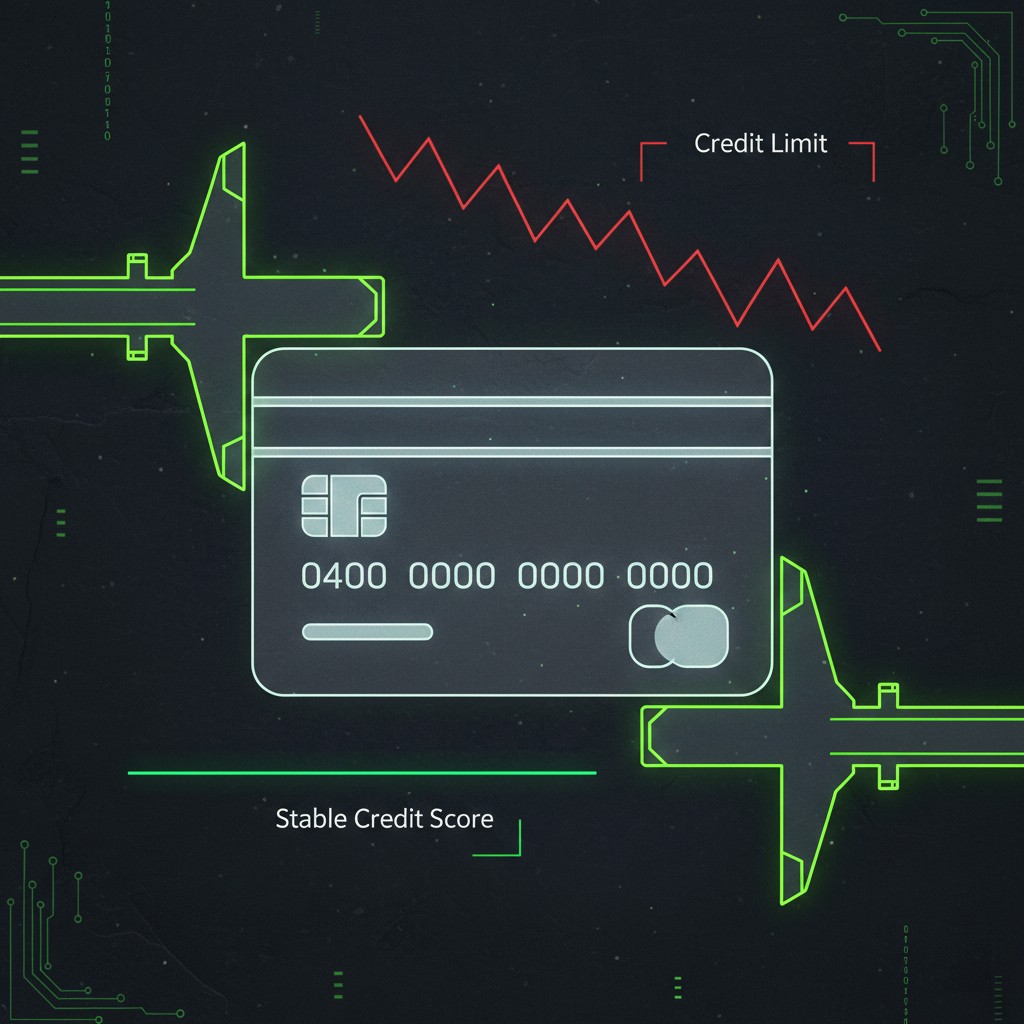

Following our longitudinal study of the credit threshold effect, this research explores Silent Credit Contraction as a direct systemic consequence. This phenomenon represents a shift in 2026 risk management where algorithmic lenders reduce exposure through metadata calibration rather than traditional score-based triggers. In this environment, a stable credit score no longer guarantees limit preservation, as AI systems prioritize latent risk markers over lagging numerical indicators.

In the 2026 credit ecosystem, financial institutions utilize probability-based auditing to preempt systemic fragility. When the underlying systemic mechanics of a profile signal a drift toward boundary-adjacent behavior, the system initiates a proactive reduction in available credit. This contraction occurs “silently” because it bypasses the consumer-facing credit score, appearing instead as an internal adjustment within the lender’s risk architecture.

The Role of Metadata Calibration in Automated Audits

From an analytical perspective, Silent Credit Contraction serves as a defensive response to detected behavioral recurrence patterns. While the primary credit score reflects historical payment success, AI auditors monitor real-time data flows to identify a “financial inflection” point. If the transactional metadata suggests an increasing reliance on revolving liquidity to manage structural friction, the system triggers an automated limit recalibration to protect institutional solvency.

This is a general educational framework, not personalized financial advice. We are not a credit bureau, lender, or scoring model provider. Regulatory bodies, including those observing Federal Reserve prudential standards, have noted that these automated contractions are increasingly common in volatile market conditions. The AI evaluates the structural consistency of a profile; if the internal margin of safety diminishes, the system compensates by restricting the maximum available stretch, regardless of the profile’s nominal score.

Structural Friction Dynamics and Latent Risk Markers

The structural friction dynamics of the 2026 lending landscape favor profiles that exhibit “Inelasticity” under stress. When a profile displays a sudden increase in transaction frequency or a shift in merchant category clusters, the AI identifies latent risk markers. These markers suggest that a credit reversion behavior may be imminent, even if no payment has been missed. The system treats these signals as a lead indicator of potential delinquency.

Profiles that maintain a high degree of “liquidity reserve” relative to their limits are less likely to experience these silent interventions. The AI interprets the absence of limit-testing as a sign of structural robustness. Conversely, profiles that consistently hover near their invisible risk boundaries trigger a “Shadow Review,” where the risk engine may unilaterally contract the limit to align with the borrower’s perceived cash-flow stability.

Utilizing Interpretive Modeling Tools

Navigating the mechanics of Silent Credit Contraction requires an understanding of how AI systems interpret non-obvious data points. Risk engines analyze the relationship between income stability signals and credit engagement rhythms. Transactional metadata is often the primary driver of these backend adjustments. Borrowers can simulate these behavioral impacts using centralized modeling tools available at our resource hub.

These resources function as an analytical modeling aid for observing modeled boundary behavior. By examining how specific spending cadences influence trust metrics, observers can better understand the logic behind automated limit adjustments. This knowledge allows for the maintenance of a credit footprint that signals long-term stability rather than immediate liquidity dependence.

The Shift Toward Discrete State Recognition

As we move deeper into the 2026 credit cycle, Silent Credit Contraction will remain a standard tool for algorithmic risk mitigation. Stability is no longer a static number but a reflection of structural consistency across all data dimensions. Risk classification now favors profiles that demonstrate a persistent “Buffer Zone” between their actual usage and their total capacity.

This research indicates that the 2026 auditor is less concerned with the “score” and more focused on the “system.” By reducing the presence of behavioral recurrence patterns that signal stress, profiles can maintain their structural integrity within automated frameworks. Predictability remains the most valued attribute in a landscape governed by discrete state recognition and real-time metadata auditing.

Research Abstract: Metadata-Driven Contraction

This study defines Silent Credit Contraction as a proactive risk mitigation strategy utilized by 2026 AI lenders. Unlike traditional limit reductions, this process is driven by metadata calibration and latent risk markers rather than credit score changes. Our findings suggest that AI systems prioritize structural consistency, unilaterally shrinking limits when profiles exhibit behavioral signals associated with systemic fragility.

| Mechanism | Primary Trigger | Visibility to Borrower |

|---|---|---|

| Score-Based (Obsolete) | Payment Delinquency / Score Drop. | High (Alerts Issued). |

| Metadata-Based (2026) | Latent Risk Markers / Inflection Points. | Low (Internal Calibration). |

Data Accuracy Note (2026): Market conditions, Federal Reserve interest rates, and lender algorithms change rapidly. While we strive to provide the most accurate insights as of January 2026, we recommend verifying all specific loan terms and APRs directly with your chosen platform before signing any agreement.